Achieving Ultra-Low Latency in Trading Infrastructure

Latency has been a hot topic in financial markets since the rise of high-frequency trading in the early 2000s. Low latency has been replaced with ultra-low latency (ULL) in liquid markets as technology has slashed tick-to-trade latencies below one microsecond. While many vendors outline how their products contribute to a faster trade, connecting all the pieces for a comprehensive trading infrastructure requires great technical expertise within your firm. So, we’ve outlined common technology, networking, and trading strategy decisions needed to achieve ultra-low latency.

How Trading Strategy Impacts Ultra-Low Latency

Latency of a trading strategy is dependent on a firm’s specific algorithms. However, some general decisions around trading strategies will help you acknowledge how latency-dependent the algorithms are, and whether ultra-low latency is worth the infrastructure investment required.

Latency-sensitive strategies are those in which faster trades provide more alpha but gains still can be made without ultra-low latency. Frequently, these are multi-market strategies, where fragmentation makes it impractical to carry out ultra-low latency with each exchange. Here, latency can be reduced through networking decisions, such as choosing microwave connections between data centers to edge out traders relying on fiber-optic cable.

The latency from data normalization and order routing increases with market fragmentation due to the increased complexity of feeds. Competing in a fragmented market requires sufficient capacity, so a ticker plant with high throughput becomes an important part of your plans.

Latency-dependent strategies–those in which the loss of nanoseconds threatens a trade’s profitable execution–are the ones that necessitate ultra-low latency. They’re most achievable in single-market situations, where you can optimize every step of the tick-to-trade loop between your trading infrastructure and the exchange. An example might be a futures strategy on one of the CME Group’s exchanges, which make up the majority of trading volume in the US futures market.

An awareness of the difference between latency sensitivity and latency dependence helps a firm determine what type of networking and infrastructure decisions need to be made to accomplish its trading strategies.

ULL Networking Throughout the Infrastructure

Latency can be defined as the time interval between any two points in a trading infrastructure. Yet, the tick-to-trade latency–the time difference between the order reaching the exchange and the market data that triggers it–is essential to creating an architecture with a trade lifecycle under one microsecond. Focusing on this latency measure requires understanding the networking between your hardware and that of the exchange with which you’re trading.

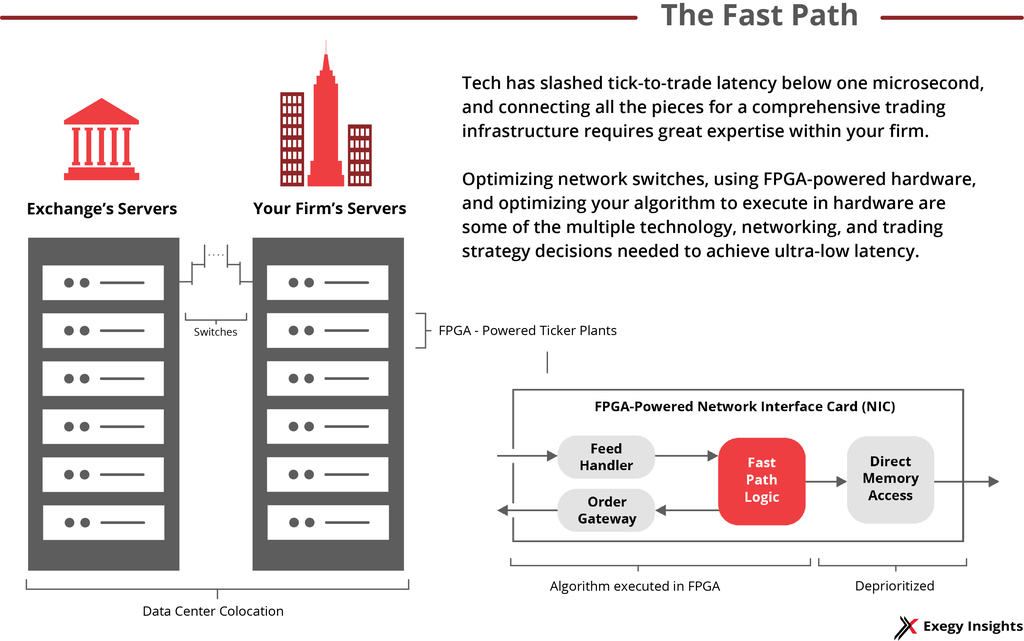

The typical but expensive requirement for ULL is co-location and market data feeds directly from the exchanges. The ultimate limit of latency in data transmission is the speed of light, and the distance data packets travel correlates directly with time. Therefore, firms elect to co-locate their rack space in the same data centers as exchanges and cross-connect cables to minimize physical transmission distance. Market data feeds direct from exchanges—as opposed to consolidated feeds from the SIPs or a third-party vendor—prevent added latency caused by processing those consolidated feeds.

In addition to direct feeds and co-location with exchanges, ultra-low latent networks must consider the network switches at each point in the trading infrastructure. Switches are hops data makes as it bridges devices in a network, and they are a focus in optimizing tick-to-trade latency. Each hop accounts for approximately 100 nanoseconds, although technology is making inroads here. New hardware can reduce latency by up to 50%.

To reduce switches, market data teams opt to connect directly to an exchange’s port instead of an intermediary hosting provider. The fees for a direct connection add up: The CME Group charges $12,000 per month (plus a $2,000 one-time fee) for client-managed connectivity to the CME Globex platform at its co-location center in Aurora, Ill., making it a six-figure annual investment to secure the lowest possible latencies.

Ultra-Low Latent Trading Technology

Application-specific hardware is the foundation of attaining ULL, and while many vendors provide piecemeal components, there are a few standard elements to build upon.

For the tick-to-trade infrastructure, field-programmable gate arrays (FPGAs) have become a common baseline for ULL as an improvement over software running on commodity servers. FPGAs define steps in the trading process mechanically through logic gates, rather than through a list of software instructions, resulting in higher, more consistent speeds, even in periods of high volume.

In addition to FPGAs, ticker plant hardware has increased processing speed and processor count to optimize the loading and ordering of data packets. Network bursts on volatile trading days can cause serialization or queueing latency that may erode or eliminate a profitable trade. Many firms seek packet burst data, like that found on Market Data Peaks, to estimate needed network capacity and processing power. Ultimately, it’s critical for ultra-low latency traders to ensure a tick-to-trade system can consume, process, and complete the logic of a trade at the same rate the market is moving.

Throughout the tick-to-trade lifecycle, there are steps that might be de-prioritized or removed in the chase for the fastest order. For trading applications that depend on ULL infrastructures, algorithms may execute entirely within an FPGA device. Further, proprietary traders may run their execution management system (EMS) concurrently with order execution, forgoing pre-trade risk assessments and margin requirements checks to assure lowest possible latency. While this option only applies to firms that aren’t liable to customers’ standards or execution compliance, it does heighten risk for the firm. Also, exchanges increasingly require certain pre-trade risk checks.

There are many ways to decrease trading latency, but when it comes to ultra-low latency, all enhancements are crucial. This results in high capital expenses for technology and recurring fees for priority access to market data. For the market makers and proprietary traders who make the investment, the impact is evident. High frequency trading is estimated to be involved in 55% of all US equities market volume.

At Exegy, we understand more about our customers’ latency challenges than what is measurable in our products. As an industry leader of low latency technology, we continue to innovate products for the demanding latency needs of global market makers, proprietary traders, and broker dealers.