Signum Iceberg Detector Tracks Musk’s Selloff of Tesla Shares

With this week’s report that Tesla CEO Elon Musk unloaded another $3.5 billion in Tesla shares, Exegy’s iceberg order detection capabilities were once again on display.

Musk reported to the SEC this week that on Dec. 12, 13 and 14, he sold a combined total of nearly 22 million shares, at prices ranging from $176.702 (on 12/13) to $156.141 (on 12/14).

But you didn’t have to wait for those official reports to see the massive selloff in TSLA, thanks to our Signum signal that detects iceberg (or reserve orders). Reserve orders are a special order type offered by the exchanges that allows large institutions (and company insiders such as Musk) to sell large blocks of shares discreetly.

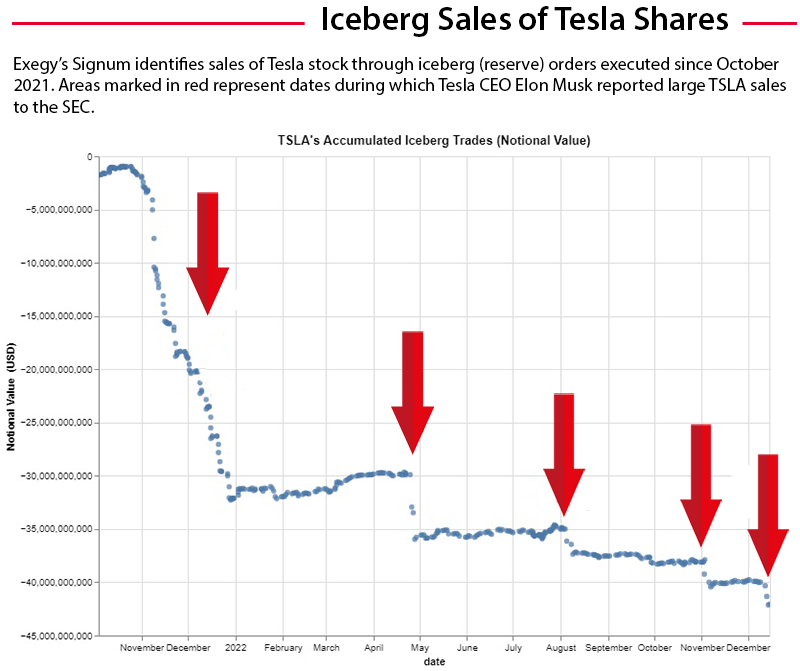

Our Signum Signal shed a light on that institutional activity:

- on Dec. 12, it detected $473 million in iceberg selling of TSLA;

- on Dec. 13, it found another $1.217 billion;

- on Dec. 14, it detected another $1.179 billion in iceberg sales, for a three-day total of $2.869 billion.

This compares to the prior 20-day moving average notional selling value for TSLA of $158 million.

What was Musk’s SEC reporting for those three days?

- Dec. 12: $540 million

- Dec. 13: $1.953 billion

- Dec. 14: $1.088 billion

This indicates that some of Musk’s sales of Tesla shares were completed without using iceberg orders.

It’s not the first time that Musk has engaged in a large-scale selloff of TSLA shares; from Nov. 8-Dec. 28, 2021, he sold more than $16 billion, as well as smaller selloffs in April, August, and November of 2022. Each time, our Signum Signal was able to illuminate those sales as they happened, before official reporting confirmed them (See figure).

And it’s not just Tesla: In August, we saw how our signal cut through the hype surrounding Bed Bath & Beyond, revealing rapid institutional selling even as BBBY’s stock price soared.

Our iceberg order detection signal keeps you in the loop of what large firms and informed insiders are doing, giving you time to react as they make big moves. This signal data is available as an end-of-day summary with .csv files delivered via AWS or GCP.

Don’t be left in the dark; talk to us today about how to leverage information about institutional trading in your own strategies.