How Shifting Market Structure Affects Trading Systems

It is no revelation that US market structure is shifting. The now infamous short squeeze of hedge funds by Reddit group Wallstreetbets (r/WSB) was a long-time culmination of factors: the flood of retail traders entering the market via gamified apps like Robinhood, social media coordinated trades, the rise of zero-commission trading, and government stimulus checks paired with stay-at-home orders.

Bloomberg’s Luke Kawa predicted the snowball effect that retail interest in long call options could have on market makers who hedge their positions. When Kawa wrote his article in February of 2020 r/WSB had 900,000 users. A year later in mid-February of 2021 it has over 9 million users.

These numbers show that mass interest in investment paired with improved accessibility and communication are likely here to stay—meaning existing market participants will have to adjust to increased competition, transparency, and consistently high-volume during spikes rather than bursty volatility patterns. All these factors contribute to more opportunities to capture alpha with the right trading infrastructure.

The GME Short Squeeze

In recent years, the world has witnessed several mass movements fueled by social media. Reddit has been the platform of choice for retail investors whose coordinated activities translated into historic movement on US markets. As of Jan. 15, over 88% of GME shares were shorted summing up to an estimated 61 million shares. This is an incredible number of shares shorted on GME, compared to similar big-name retailer stocks like Barnes & Noble sitting at 2.8% of shares shorted or about 1 million shares. Even the likes of TSLA, a historically overvalued stock, sits only at about 5% of shares shorted.

This large number led retail investors on r/WSB to buy up shares of GameStop attempting to drive the price high and squeeze short sellers out of their positions. However, there is speculation over whether retail investors were responsible for most of the buys. JPMorgan’s analysis found that GME was not in the top 10 bought stocks in January 2021 by retail investors, causing many to conclude that institutional investors jumped on the trend and moved most of the weight.

The Tail Wags the Dog

One of Exegy’s indicators has revealed similar findings. Exegy’s Signum signal Liquidity Lamp detects reserve order activity—an order type used by institutional investors to minimize information leakage and price impact for large orders. On January 27, 2021, Liquidity Lamp reached a recorded high of 403 million reserve orders of AMC, one of the supposed targets of retail investors on r/WSB, revealing significant institutional participation.

In corroboration, Liquidity Lamp also signaled concentrations of execution activity on AMC when reserve orders were resting on the market by a ratio of 29:1 on February 1, 2021. This is another signal that sophisticated institutional traders with the ability to detect iceberg orders were trading with (or against) the large institutional orders resting on the markets. Historically retail investors follow institutional sentiment, riding the coattails of professional investors; however, the evidence in this case points to institutional investors following retail traders.

Shifting Volatility Patterns

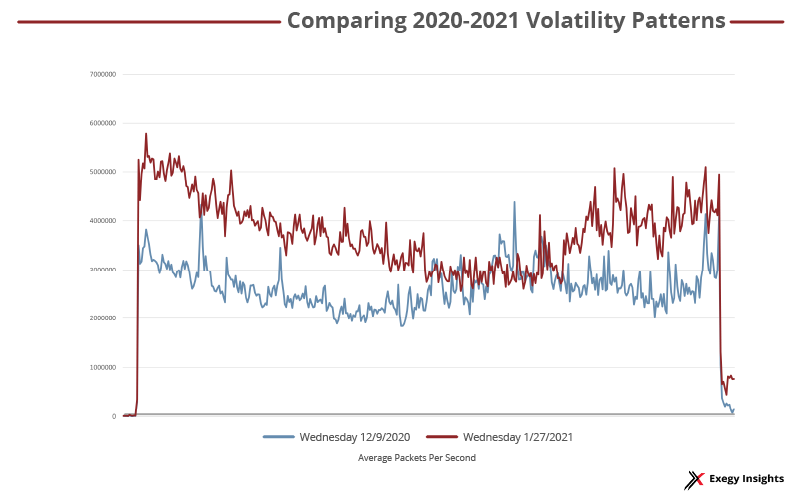

Monitoring the rates of real-time market data feeds is another key metric of market structure that is followed closely by Exegy. In collaboration with the Financial Information Forum (FIF), Exegy reports market data rates for US equities and derivatives on MarketDataPeaks. The reports from two different Wednesdays show how periods of volatility in 2020 operated as compared with the January r/WSB short squeeze. In the past, periods of high volatility were characterized by short bursts of high volume, seen in both message and packet rates. These bursts frequently reached 3 times the daily average rate or more. Starting with the Covid crash of 2020, a new pattern started to emerge. This new pattern shows fewer bursts, but average rates increase by 1.5 times or more. Given what we have seen during the GME short squeeze, it is becoming clear that this activity, likely driven by the transparency of social media, is becoming the new normal. It creates a market where retail traders, hedge funds, and institutional investors are all moving with different strategies around the same underlying security.

The blue line shows the average packet per second for Wednesday, December 9, a week before electoral college votes were due. Market data rates saw more than usual election-time volatility levels as delayed decisions, vote recounts, and questions about whether Democrats or Republicans would run the Senate weren’t solved until weeks later. The market data showed many periods of the day affected by drastic bursts in activity ranging from under 2 million packets per second on average to over 4 million packets per second on average. While volatility on Wednesday the 27th of January 2021 showed more consistently high packet rates with less burst activity.

Firms should expect this type of volatility to continue through 2021 and beyond. Retail participation through apps like Robinhood and social media are here to stay. But this isn’t anything shocking; the US markets have been moving in the direction of accessibility since the early ‘70s and technology has only accelerated this trend. Market participants recognize that more traders equal more efficient and liquid markets. As the SEC begins to recognize and standardize retail trading activity, it will only become more efficient.

Staying Ahead of the Crowd

Another indicator set off by the GME short squeeze was Signum’s Quote Vector, which predicts directional price movement. In a world where one tweet, or post, or Reddit post can shift markets, Quote Vector can help firms stay ahead of the trends.

The first month of 2021 alone acts as a tribute to the value of predicting directional price movement. Firms using Quote Vector during the intense volatility occurring on January 27 and 28 had the potential to see a price improvement of $75 million and then $85 million respectively. Quote Vector tracks crumbling and rising US equities quotes with accuracies up to 88%—an excellent tool for tracking movements of the underlying equity as derivatives markets explode.

Learn More About Market Structure Through Exegy

Exegy is constantly tracking market data rates through MarketDataPeaks to quantify market conditions. Exegy’s Signum signals go even deeper: highlighting reserve order movement with Liquidity Lamp, predicting the direction of price movement with Quote Vector, and the timing of that movement with Quote Fuse. Signum was recognized by the SEC for democratizing predictive trading in markets dominated by algorithmic trading.

For more information about how Exegy can help your firm stay ahead, enjoy a free consultation with one of our experts.