SEC Decentralizes SIP Feeds and Revamps Data Requirements

In February of 2020, the Securities and Exchange Commission (SEC, Commission) proposed a plan to expand the market data made available in the Securities Information Processors (SIP) feeds and to allow competing consolidators to register as alternative SIP providers. Exegy is a provider of SIP and proprietary data feeds that can help prepare for the changes to come whether clients are interested in consolidating, aggregating, or consuming SIP feeds.

The plan is a recognition that the current SIP feeds do not offer enough information for best execution and equal opportunity for investors across the board.

Undeterred by opposition from some exchanges and venues, the SEC voted unanimously to adopt the proposal early December 2020, meaning major changes to come for the market in the years ahead.

This will affect investors that rely on Level 1 market data, expanding their scope to include certain depth-of-book information, odd lots, and auction information vital to opening and closing liquidity.

The SEC seeks to minimize costs and to reduce the latency of these feeds as well by creating competing consolidators that will disseminate market data, potentially at different locations and with other customizable options. Self-Aggregators have also been defined in the new plan allowing broker-dealers to create their own internal-use feeds.

SIP Data Feeds Today

The current SIP feeds consolidate quote and trade information on different parts of the US markets and are operated by two providers. The Securities Industry Automation Corporation (SIAC)/NYSE and NASDAQ enjoy a monopoly on associated fees for feed connectivity. These exchange operators also derive a growing share of their revenue from proprietary data feeds. In its new proposal, the SEC recognizes and seeks to address this conflict of interest that has impaired improvements to the SIPs.

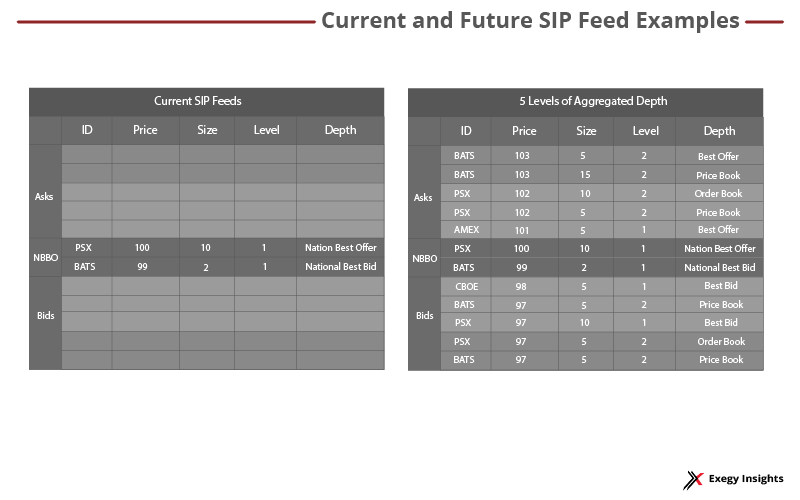

SIP feeds contain top-of-book or Level 1 market data. This means they disseminate the best bid and offer (BBO) quotes and trade reports from each NMS market, as well as compute the National Best Bid and Offer (NBBO).

The SEC feels the information provided is no longer sufficient in complying with Section 11A of the Exchanges Act of 1934 that calls the Commission to action in keeping the market efficient and fair for all participants. Members of the Commission who spearheaded the proposal stated that today’s national market system (NMS) data only works for retail or display traders and even then, at a disadvantage to those with more in-depth and lower-latency data.

It is widely agreed upon that most institutional investors require proprietary feeds bought directly from exchanges to ensure best execution and fair competition with (High Frequency Traders) HFTs, hedge funds, and asset managers. Yet only an elite few can afford the subscription fees and infrastructure needs that come with sourcing proprietary data feeds.

Redefining Equity Market Data

Due to the aforementioned conflicts of interest with the for-profit exchanges, the SIP feeds have not undergone major changes since they were first created in the 1970s. Markets have automated, accelerated, and expanded since then. Latency has been drastically reduced, while the amount of available market data has increased. To keep up with changes the SEC is mandating that SIP feeds add depth-of-book, odd lots, and auction information to make the minimal amount of data needed for trading accessible.

Depth-of-Book Data

The SEC cites decimalization that occurred in 2001 as a reason for choosing to add depth-of-book data to SIP feeds. Decimalization changed the minimum price increment from 6 cents to 1, subsequently creating many new price levels. With depth-of-book data SIP users can essentially view the original spread that occurred pre-2001, or about 6 cents off the NBBO.

As per the new standards, SIP data will now include the NBBO and 5 levels of price aggregated depth. SIP data will also include information on which exchange that liquidity lies. This will aid in order routing decisions and price discovery, and will allow broker-dealers to see imbalances in the price book.

Proprietary data feeds direct from exchanges can include every bid and offer available, including more granular Level 3 or order-level market data. The SEC chose not to include every bid and offer available leaving much of the proprietary data market to exchanges, while still expanding access on the SIPs.

Redefining Round Lot

Round lots were once the standard for trading shares and usually refers to a lot of 100 shares. Anything below 100 shares is considered an odd lot and, depending on the trading venue, may have been segregated into a separate pool of liquidity. As a result, SIP quotes have not previously included any odd lot information.

A lot of liquidity lies in odd lots for important stocks that have become more expensive as their share prices have appreciated rapidly and splits occurred infrequently. This results in a more significant proportion of trading in odd lot sizes and exacerbates the disparity between the content on the SIP feeds (with no odd lot quotes) and expensive proprietary feeds.

In response, the new SEC proposal defines four standard tiers of round lots based on share price. This effectively expands the view of quoted liquidity via the SIP feeds. The SEC also points out that including odd lots in the SIPs benefits all market participants as it will provide a more accurate price discovery. For transparency purposes, the SEC mandates that exchanges publish any odd lot information that is better than the NBBO for any lot size.

| Share Price | Lot Size |

| $250 or less | 100 shares |

| $250.01 – 1,000 | 40 shares |

| $1,000.01 – 10,000 | 10 shares |

| $10,000.01 or more | 1 share |

Capturing the Close

As passive index funds gain popularity so too do the final moments of the trading day. Passive funds are valued based on closing asset prices, meaning they tend to rebalance during the closing auction. This end of day activity is responsible for 20% or more of the daily volume.

Prior to these updates only market participants with proprietary feeds had detailed auction information. The SEC is attempting to even the stakes by adding this information to SIPs, stating that all auction information publicly disseminated by exchanges on their proprietary feeds needs to be included in the SIP.

This includes things like order imbalance information which details when there is an imbalance or excess of buyers to sellers for a given security, allowing participants to either profit off the spread of provide liquidity. Indicative price matches will also be included, revealing where a maximum number of orders can be sent by detecting multiple price matches for a given security.

It is worth noting that the rule remains open ended to include data that may emerge surrounding closing auctions. A theme of this plan by the SEC is to provide regulation that accounts for a dynamic and ever-changing market data landscape. One that will likely see many changes as the SIPs deconsolidate and open to competition.

Competing Consolidators

The current SIPs run by NYSE and NASDAQ are required for best execution as they are the only producers of the official NBBO that is the de facto standard for enforcing compliance with Regulation National Market System (NMS). The for-profit exchanges’ also select the plan processor, which the SEC sees as a conflict of interest—allowing NYSE and NASDAQ to control SIP feed data and proprietary data at the same time.

By allowing competing consolidators the SEC opens the provision of SIP feeds for competition and creates fair prices for better market technology, services, and data. In other words, the SEC believes that free market forces will ensure that SIP providers will respond more actively to participant needs at lower prices.

Competing consolidators also reduce latency. Those that co-locate or subscribe to feeds directly from exchanges are receiving more detailed data in nanoseconds or microseconds at most, where SIP feeds latency is tens of microseconds for local data and significantly more for remote data. Nanosecond latency is crucial for algo traders, market makers, HFTs, and predictive strategies that represent the future of institutional trading.

Part of the reason for increased latency in the current SIPs is that they are disseminated from one location in New Jersey: CTA from the SIAC/NYSE location in Mahwah and UTP from the NASDAQ location in Carteret. The US markets that comprise the National Market System operate out of three locations in New Jersey—Secaucus in addition to Mahwah and Carteret.

Under the current SIP plan, all market data related to a specific listing must be reported to the SIP operator associated with the listing market. This means that an updated quote on an NMS exchange may need to travel to a different location to be processed by the SIP, then travel to the market participants receiving the SIP feed—even if the participants are co-located with the reporting NMS market.

The geographic latency is now much greater than the time it takes to execute a trade, creating a demand for decentralized SIPs. By allowing competitors to produce SIP data, potentially within each of the locations for the National Market System, participants will be able to choose feeds based on location and further reduce latency.

Best Execution and Compliance Solutions

It appears that the SEC recognizes that this could make best execution and OMS/EMS confusing and complicated as the possibility of geographically different NBBOs exists. The Commission maintains that there are no minimum data requirements for best execution, but that brokers should use the information available to them and not discriminate between which data feed to use for which customer type.

As the leading provider of global market data solutions, Exegy is prepared to assist market participants in capitalizing on these substantive changes to the SIP feeds and infrastructure. For cost-sensitive market participants looking forward to the enhanced content of the SIP feeds, Exegy’s DataPort provides custom, normalized, real-time feeds through local cross connect, internet, or the cloud. DataPort also features vendor-of-record services for EMS/OMS compliance.

For firms planning to become self-aggregators, essentially operating an in-house SIP feed, both Exegy’s hardware and software solutions offer the capability to calculate custom NBBOs.

For vendors, service providers, and market participants considering becoming a competing consolidator, the Exegy Ticker Plant can certainly handle it. This high-capacity appliance performs at consistent speed under load and reduces server counts—allowing firms to vend SIP data with a reduced data center footprint. Exegy offers both DataPort and the Exegy Ticker Plant as a fully managed service, meaning we will be monitoring the situation 24/7 with off-hours testing and maintenance.

For more information on how Exegy can help, contact us.