Volatility Levels

(With New Optional Market Data Recording)

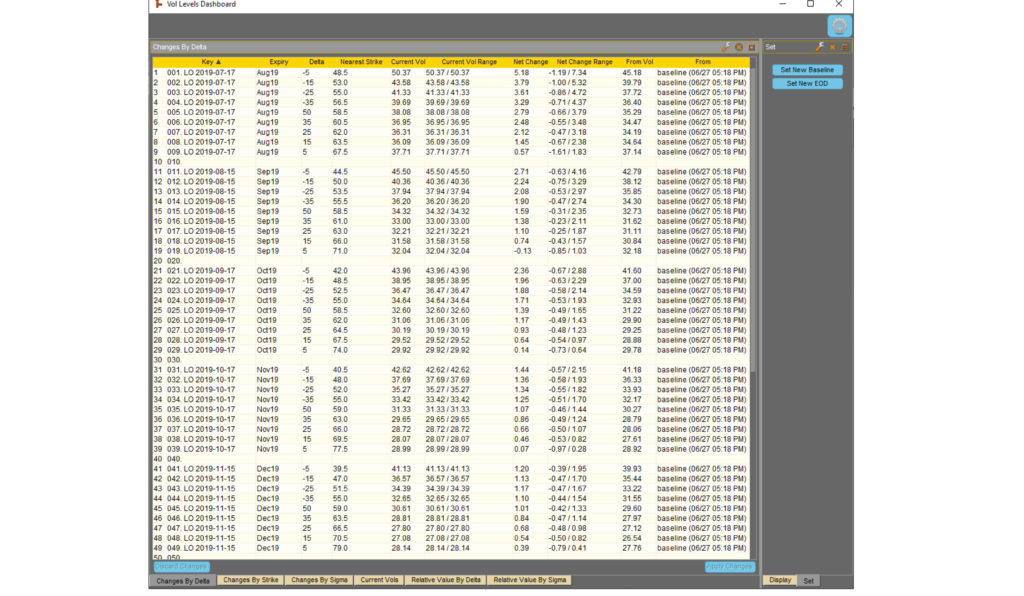

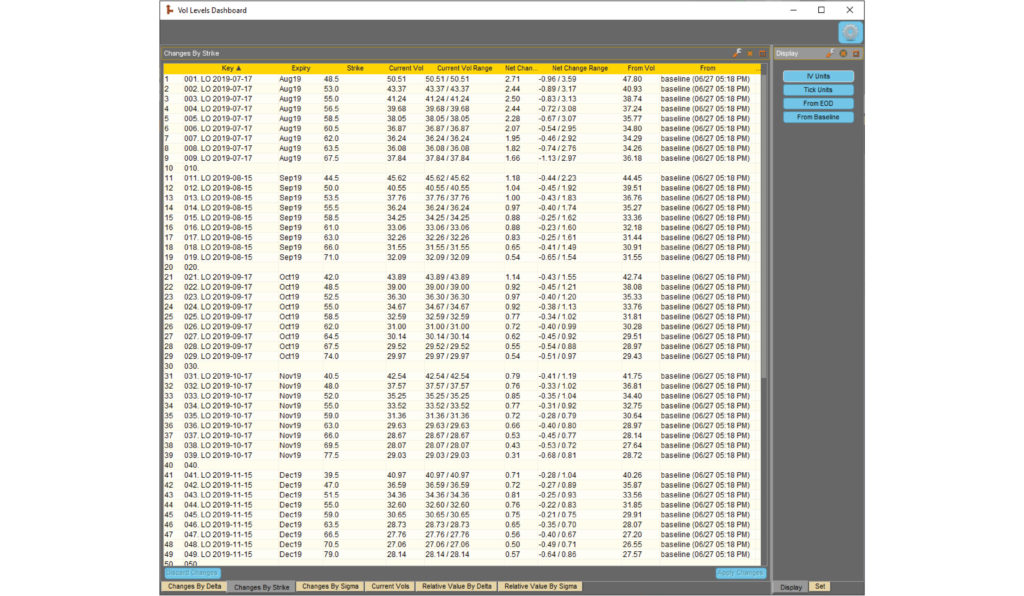

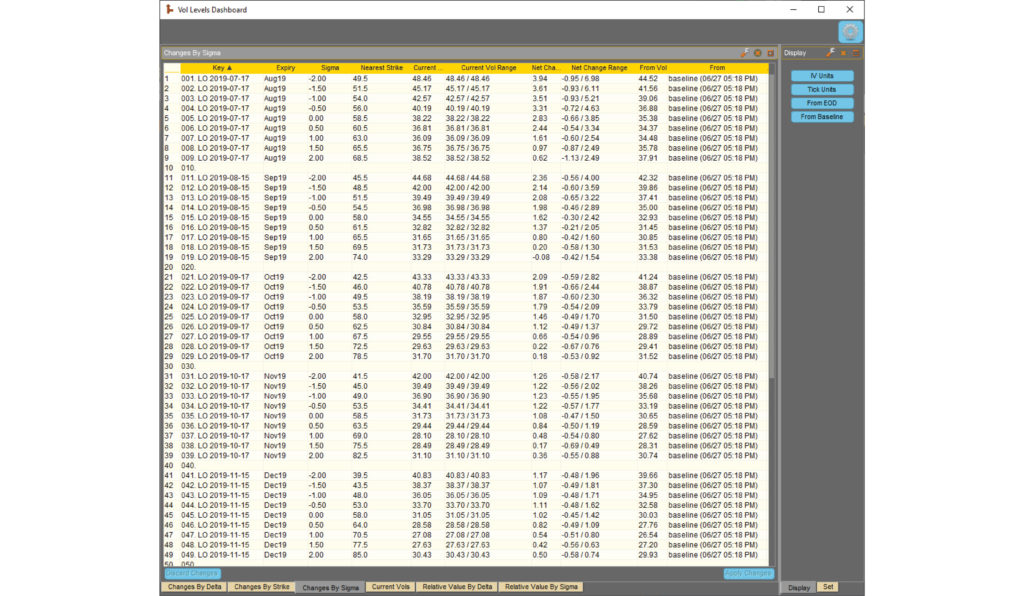

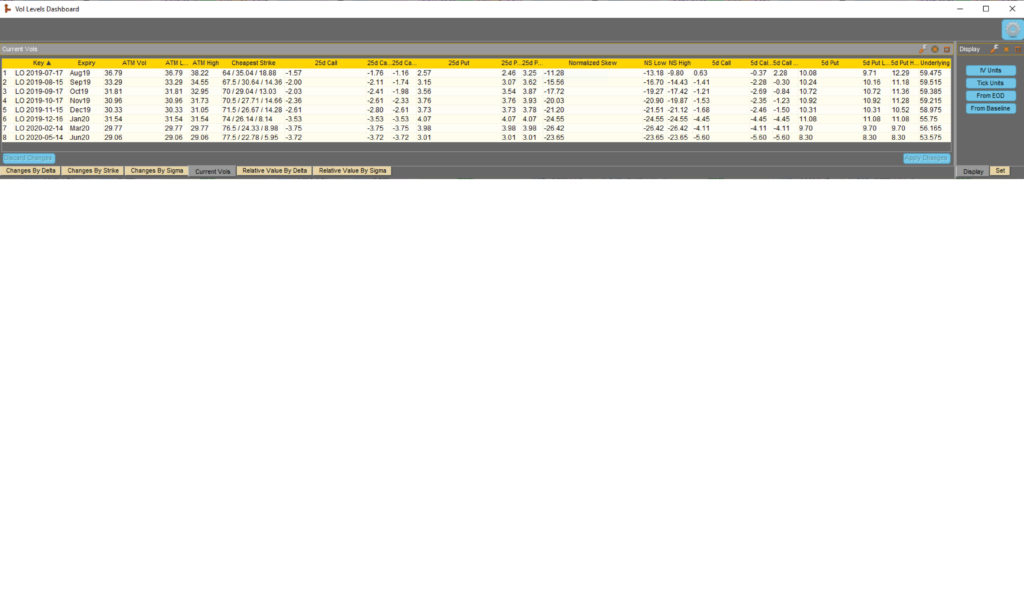

The VolLevels algo is a critical analysis tool for options traders using Exegy’s Metro platform. The VolLevels algo condenses important volatility trading information in various grids: “Changes By Delta”, “Changes By Strike”, “Changes By Sigma”, “Current Vols”, “Relative Value By Delta”, “Relative Value By Sigma”, “Skew & Kurtosis”, “Butterflies”, and “Trade Performance”. The reported information is critical to avoiding poor trades that might otherwise appear superficially attractive, and consistently identifying profitable trades with quantitative confirmation from multiple perspectives.

The VolLevels algo is the perfect complimentary tool to use in conjunction with our revolutionary realtime curve fitting tool: the Dynamic Skew algo (DSA). With a constant IV data stream generated by the DSA, the VolLevels algo can realize maximum potential.

The three “Changes By” grids provide insight into net changes in IV, as well as the high/low in net changes, from floating (delta), sticky (strike), and standardized moneyness (sigma) perspectives. Changes in IV are taken from one of two possible reference curves, and can be displayed in either raw IV (%) units, equivalent ATM tick units, or vega $ premium units.

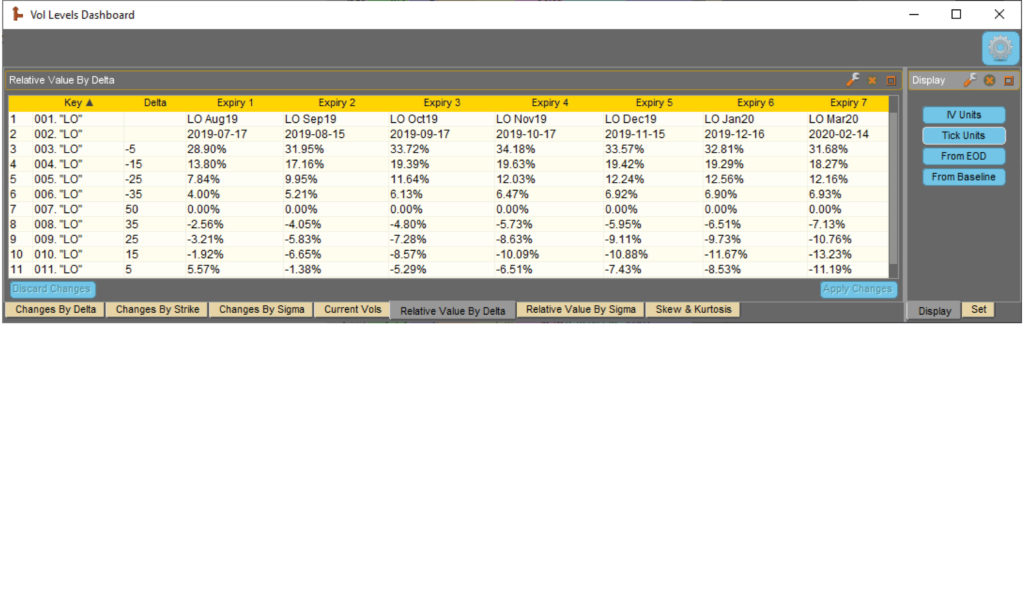

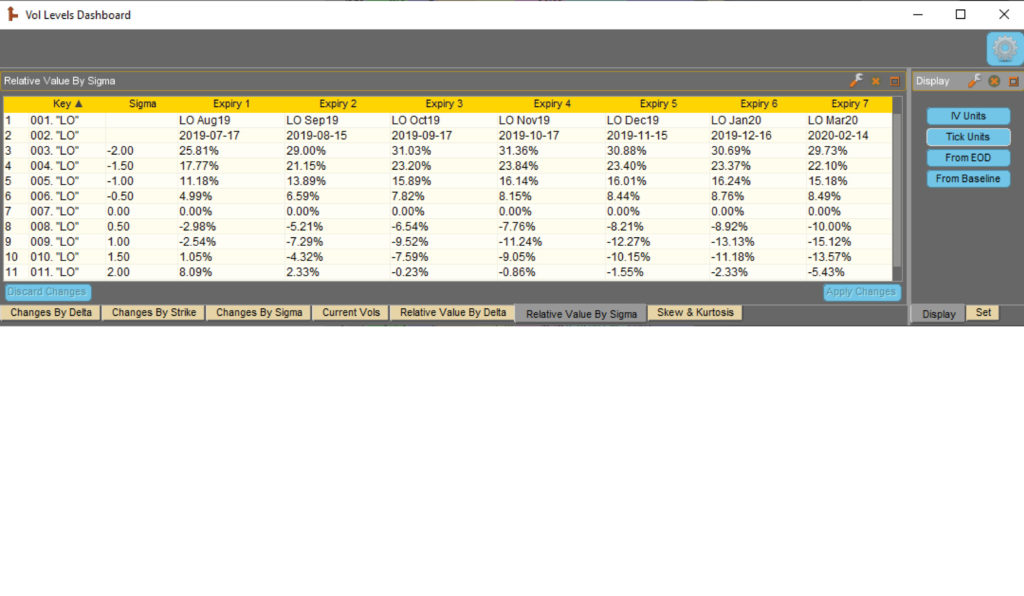

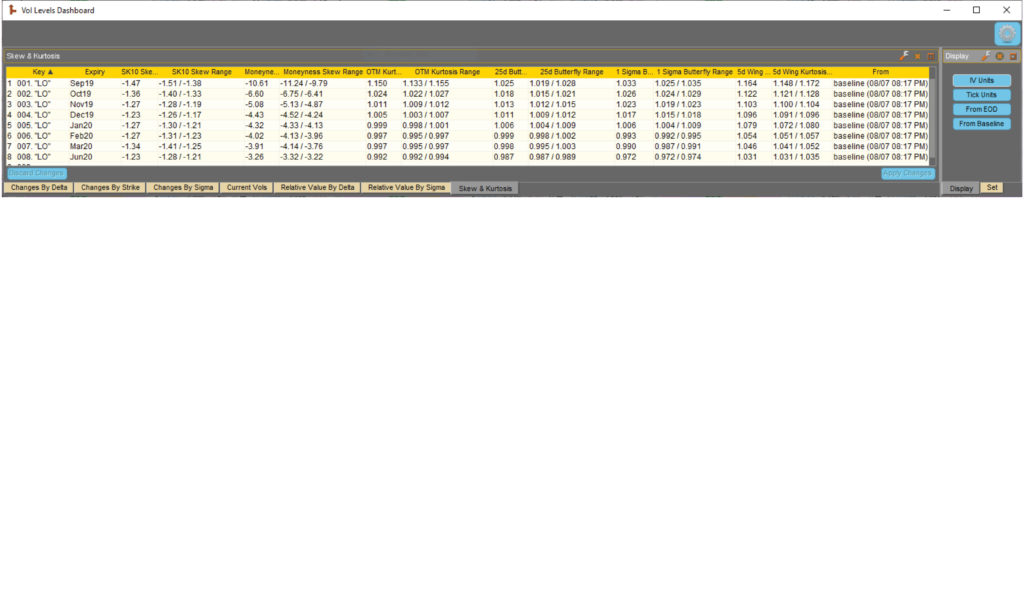

The two “Relative Value” grids allow comparisons across the term structure by displaying the IVs as ratios. The “Skew & Kurtosis” grid displays six different metrics quantifying the volatility surface.

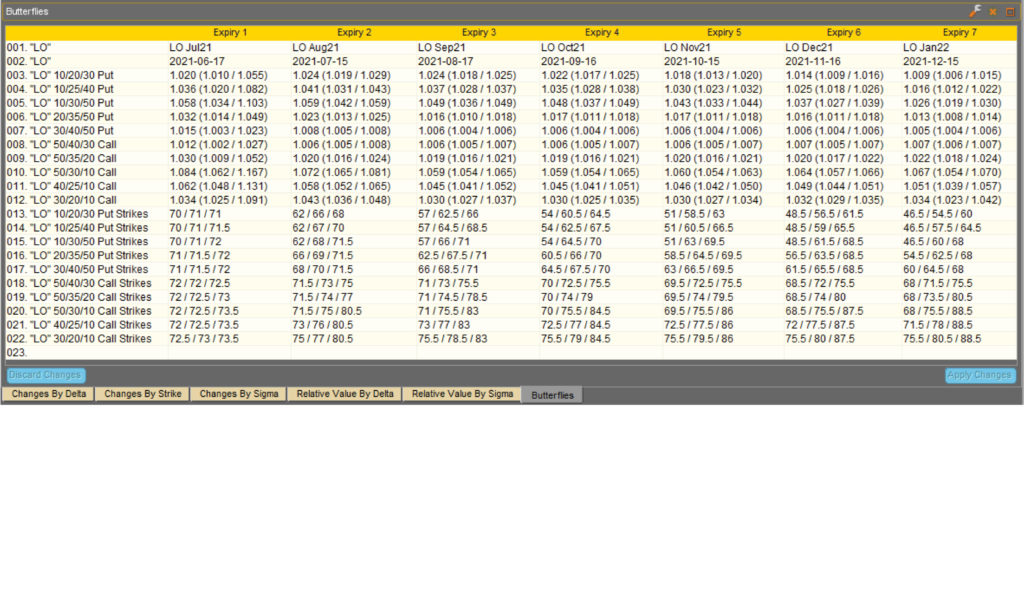

The “Butterflies” grid displays IV info on ten predefined butterflies across the term structure.

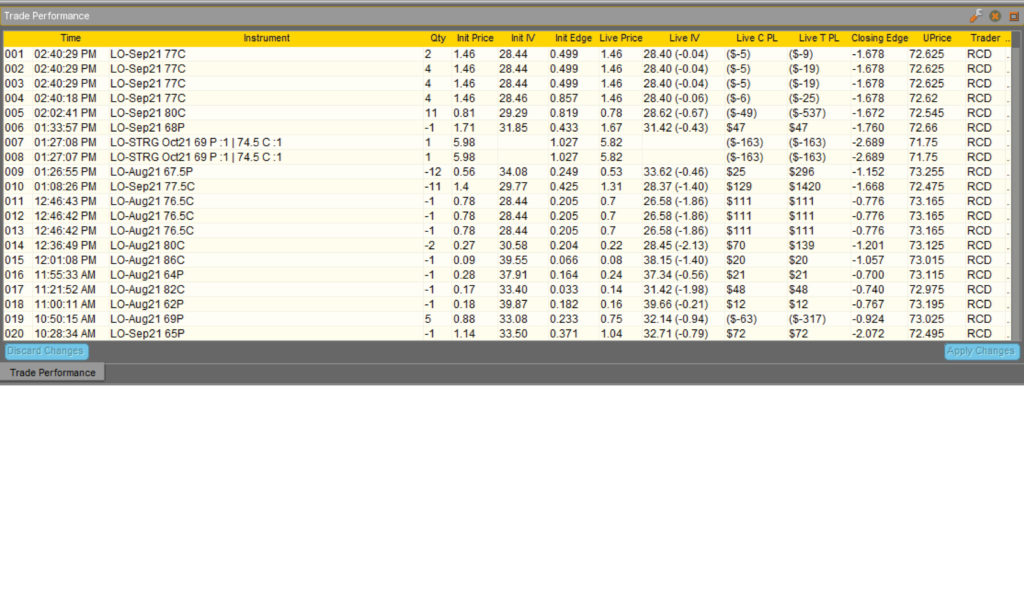

The “Trade Performance” grid displays live metrics on individual intraday trades, including live IV, live P/L $ values, and live closing edge.

The VolLevels algo can also be licensed with an optional Market Data Recording (MDR) component that allows the algo to operate on much longer time scales (in conjunction with the DSA algo). The MDR component stores IV (at various delta points and constant maturities) and underlying data on 10-minute intervals.

This allows computation of IV z-scores, IV RSI, and realized volatility [close-to-close, Parkinson, and Yang-Zhang] over longer lookback periods (up to 20 trading days).

The MDR component also allows calculation of the closely followed Volatility Risk Premium, and sophisticated leading indicators of volatility, such as VPIN, Hurst Exponent, and vol of vol. These metrics can help traders anticipate underlying trend reversals and significant moves in volatility.

Please feel free to contact the developer at kevin@axonetric.com with any questions you might have regarding technicalities, client use cases, etc.

All of the variables below can be configured or modified at runtime. This gives users the power to modify their job behavior throughout the day without having to make code changes.

| Name | Type | Default | Description |

|---|---|---|---|

| options | instruments | the options expirations to monitor | |

| verbosity | int | 1 | log detail level: 0=Minimal, 1=Basic, 2=Full, 3=Debug |

| delta_points | string | 35,25,15,5 | comma-separated list of 4 descending deltas |

| sigma_points | string | 0.5,1.0,1.5,2.5 | comma-separated list of 4 ascending standard deviations |

| sigma_points_calc | int | 0 | 0=normal (standardized simple moneyness), 1=lognormal (standardized log moneyness) |

| vol_change_units | int | 0 | 0=100*decimal vol, 1=equivalent ATM ticks |

| RESET | boolean | false | clear all saved info from the database |

| REQTRD | boolean | false | require at least one futures or options trade before vol curve tracking begins |

| REQOTRD | boolean | false | require at least one options trade before vol curve tracking begins |

| debug_flags | string |

Related Resources

Exegy Supports BMLL’s Recent Addition of Historical US OPRA Options Data

London, New York, 27 March 2025: BMLL Technologies (BMLL), the leading, independent provider of harmonised, Level 3, 2 and 1 historical data and analytics to the world’s financial markets, and…

CEO of Exegy Named Chief Executive of the Year for Leadership in Derivatives Technology

St. Louis, New York, London – February 18th, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, is pleased to announce that its…

Exegy Hires Industry Vet, Fiesel, to Build on Sales Momentum

St. Louis, New York – 9 January 2025 – Exegy, the leading provider of market data and trading technology for capital markets across the latency spectrum, is pleased to announce…