Futures Scalper

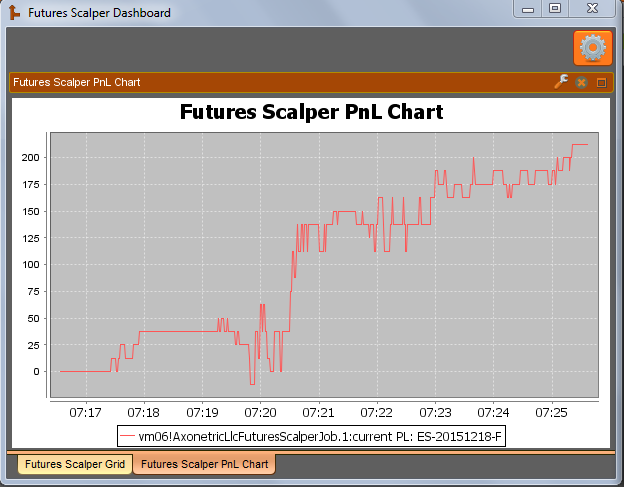

The “Futures Scalper” job allows the user to automatically trade specified futures contracts around user-defined scalp and profit intervals. The job generates appropriate new opening and/or closing orders after each trade execution. Security features are included that allow the user to specify both the absolute price range to operate within and the maximum net position permitted. Optional stop loss behavior is available, as well as the ability to optionally bias the algo toward initially buying or selling.

After an initial fill, the “Futures Scalper” will place a new buy order below that price and a new sell order above that price. New orders that add to the established position are placed at the scalp interval, while new orders with position-closing effect are placed at the profit interval. Users can choose between two different modes of booking orders: either persistent order mode (which can allow multiple orders to become laddered in the book for better queue position) or non-persistent order mode (which will never book more than one order above and/or one order below the current price). An optional user-configurable smoothing parameter allows the algo to compute a “true price” point in realtime. This “true price” involves a double-weighting of both volume-at-price and time-at-price. This feature can enhance the profitability of transient, small-scale deviations away from the “true price” by dynamically expanding the profit interval at appropriate times.

The “Futures Scalper” job also contains logic to widen out intervals by a user-defined multiplier in the case of increased volatility. By allowing the user to set a “move duration” and a “move size” for each contract, the job will automatically apply a multiplier if the future moves greater than the “move size” within the specified “move duration”. The job’s parameters will return to their normal state once the market returns to normal conditions.

Please contact the developer at kevin@axonetric.com with any questions you might have regarding technicalities, client use cases, etc.

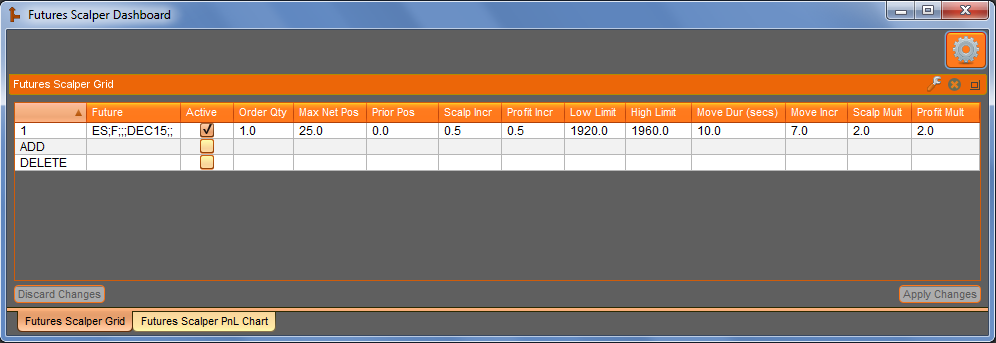

All of the variables below can be configured or modified at runtime. This gives users the power to modify their job behavior throughout the day without having to make code changes.

| Name | Type | Default | Description |

|---|---|---|---|

| smoothing_window | int | 45 | in seconds (2-100), or 0=disabled |

| onPriceLimitsExceeded | int | 0 | 0=work one-sided market only, 1=close out position and deactivate row |

| remainingPositionOnRowDeactivation | int | 0 | 0=leave as-is, 1=close out position |

| algoBias | int | 2 | 0=auto, 1=aggressive, 2=normal, 3=conservative |

| grid_name | string | the main grid will be named ‘scalpers_[grid_name]’ | |

| verbosity | int | 1 | log verbosity: 1=normal, 2=detailed, 3=extended |

| makeOrdersPersistent | int | 0 | 0=no, 1=yes |

| persistentOrderDensityControl | int | 0 | 0=off, 1=opening side only, 2=opening and closing sides |

Related Resources

Exegy Supports BMLL’s Recent Addition of Historical US OPRA Options Data

London, New York, 27 March 2025: BMLL Technologies (BMLL), the leading, independent provider of harmonised, Level 3, 2 and 1 historical data and analytics to the world’s financial markets, and…

CEO of Exegy Named Chief Executive of the Year for Leadership in Derivatives Technology

St. Louis, New York, London – February 18th, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, is pleased to announce that its…

Exegy Hires Industry Vet, Fiesel, to Build on Sales Momentum

St. Louis, New York – 9 January 2025 – Exegy, the leading provider of market data and trading technology for capital markets across the latency spectrum, is pleased to announce…