A Long-Short Index Strategy Driven by Signum

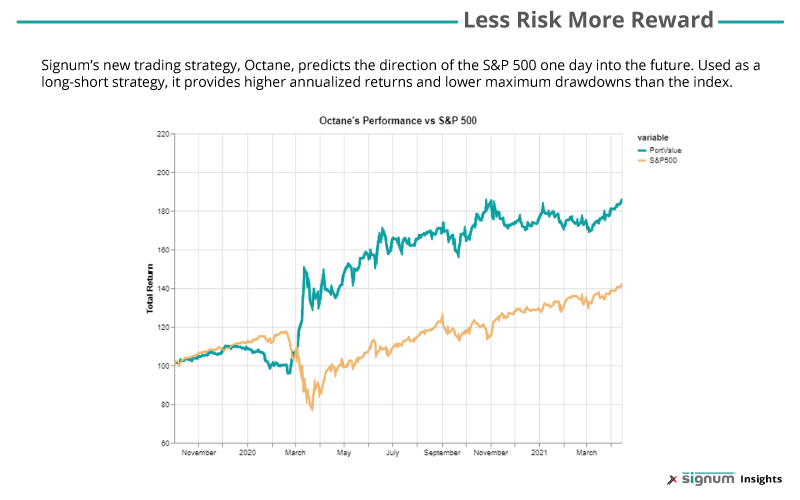

Octane is a chemical compound found in fuel that optimizes performance and reduces emissions. Now Signum’s newest long-short index strategy, Octane, is designed to do just that for portfolio performance. Octane delivers 1.9x better returns with 2.5x less drawdown when compared with the S&P 500 and a Sharpe Ratio of 4.4.

Octane is the second strategy that we have developed to demonstrate the predictive power of Signum’s Liquidity Lamp Summary (LLS) data. It uses the daily summary of reserve (iceberg) order trading activity to make a directional prediction of the S&P 500 index for the next trading session. Octane, its companion strategy – Diesel, and the underlying Liquidity Lamp Summary data are available as daily subscription services that are accessible via public cloud environments like AWS. Together, they represent a portfolio of predictive content designed to enhance the performance of a wide variety of trading strategies for a broad spectrum of market participants.

Peeking Under the Hood

Octane uses reserve order (iceberg order) data to predict the price direction of the S&P 500 index one day in the future and uses this prediction to take either a 100% long or short position on an index ETF at the open. In a previous article, we highlighted the power of reserve order data — focusing on the trading activity of informed institutional investors while filtering out the “noise” of trading activity from market makers and retail investors.

Our first strategy, Diesel, took long or short positions on individual stocks based on predictions of price direction from Liquidity Lamp Summary’s per-stock data. This strategy was mainly a defensive addition, providing less risk and reduced volatility when compared to passively investing in the S&P 500. For more information on Diesel, read our White Paper here.

Octane blends Diesel’s defensive capabilities with increased upside participation. Octane is a long-short strategy that tracks the entire S&P 500 index as opposed to individual stocks. The strategy only trades when the long-short predictions flip, allowing users to profit during rising and falling markets. Octane’s annualized return was 56.2% compared to the S&P 500’s 29.5% during the test period of 10/2/2019 – 4/15/2021.

A Blended Approach

Both Octane and Diesel strategies can be blended together with different relative weightings. This blending strategy is highly customizable, allowing optimization for different risk metrics like Sharpe ratio, profit factor, and max drawdown. These strategies, as well as the Liquidity Lamp Summary, are available as subscription datasets delivered daily via cloud services.

To find out more about optimized blended strategies for various risk metrics and the machine learning process behind Octane, check out our white paper here.

We continue to analyze LLS data and apply different machine learning techniques to derive value for our clients. Diesel and Octane are only the beginning as our data scientists explore different applications for existing signals and new signal sources. The US markets never stop evolving and neither does Signum’s signals, datasets, and strategies.

Find Out More

Signum also includes real-time signals such as Quote Vector and Quote Fuse that predict the price direction and stability, respectively, of the National Best Bid and Offer (NBBO). These powerful signals are delivered synchronously with low-latency market data—every new NBBO quote includes new Quote Vector and Quote Fuse probability values. With broad applications for execution algorithms, market making, and proprietary strategies, Signum’s real-time signals allow market participants to optimize execution quality and capture more alpha.

To learn more, view our other whitepapers, request demo data, or contact us for a free consultation.

Want to learn more about Octane? Get a guided tour of our alpha dashboard that shows how our strategies generate unique alpha.