Level 2 Market Data: What Level Supports Your Trading Strategy?

How to use Level 2 market data and how it fits within your firm’s strategy to ensure proper market data budgeting.

For display traders, Level 2 commonly describes the subsequent quotes to the best bid and ask at either end of a spread. However, there is more distinction to Level 2 and the order book when planning for market data requirements. Understanding the types of market data is first in delineating market data access needs. More so, understanding how access translates into needs for the exchanges’ direct feeds is key to ensuring meaningful conversation around goals, needs, and costs for a more profitable trade strategy.

What is Level 2 Market Data?

Level 2 is a generalized term for market data that includes the scope of bid and ask prices for a given security. Also called depth of book, Level 2 includes the price book and order book, listing all price levels of quotes submitted to an exchange and each individual quote.

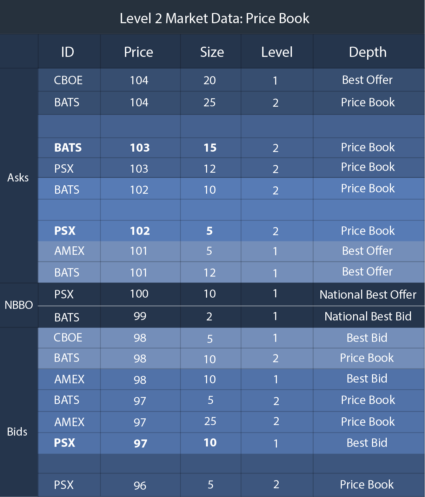

The price book (also called “market-by-price” or MBP) aggregates quotes at the same price, showing all quotes for the same bid or ask price as one line in the book and one aggregate volume. Certain exchanges offer summarized views of the price book, supplying the 5-15 highest bids and 5-15 lowest offers to simplify the book view and provide more affordable access to Level 2 data. For traders, the price book is an easily referenceable view of demand for a security and can underscore where points of support or resistance exist.

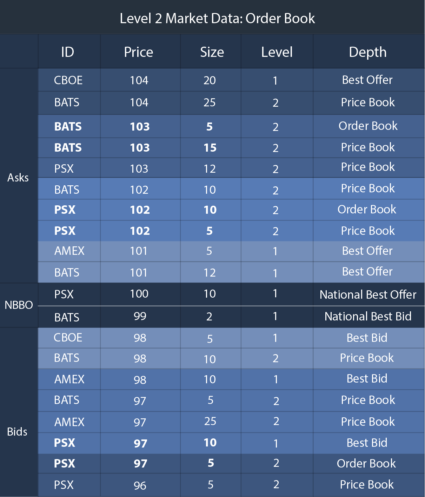

Conversely, the order book (also called “market-by-order” or MBO) provides a more granular view of Level 2 data, listing all quotes at each price level. This depth of book for a security is valuable for garnering the true demand and more accurately forecasting the behavior of price movement. The order book is referenced by some professionals as Level 3 market data to distinguish the detailed view of quotes from the aggregated view of a price book. Regardless of terminology, understanding the nuances allows a broker-dealer or asset manager to better assess market data needs and communicate those to suppliers and connectivity providers.

If you’re unsure what Level 2 data your firm or trading desk uses, look at the book for multiple quotes at the same price. Multiple quotes from different banks confirm the Level 2 data is the order book and not a summarized or aggregated view of book depth.

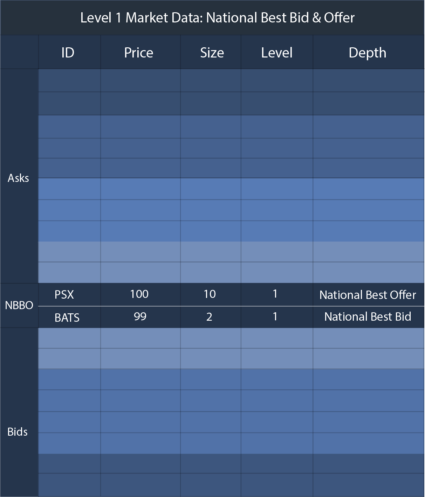

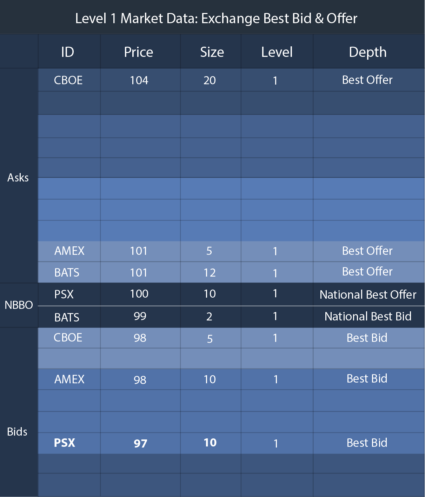

Alternatively, Level 2 is sometimes used on trading displays to differentiate the best bid and offer (BBO) at each exchange from the national best bid and offer (NBBO). Each of these views are commonly considered Level 1 data or top of book, as they lack the distinction of price levels for bids and asks. While the BBO of all 13 exchanges may emulate a price book, the BBO listed second may not be the second-best bid or offer in the price book.

Table 1. The types of market data quotes summarized by their level and book depth.

| Tiers of market data | Description of data | Level of market data | Book depth |

| National best bid and offer (NBBO) | Highest bid and lowest ask across 13 exchanges | Level 1 | Top of book |

| Exchange best bid and offer | Highest bid and lowest ask of each exchange | Level 1 | Top of book |

| Price book, or MBP | Each price level that a bid and ask has been submitted | Level 2 | Depth of book |

| Order book, or MBO | Each order at every price level that a bid and ask has been submitted | Level 2 (some refer to it as Level 3) | Depth of book |

How to Read Level 2 Market Data

The order and price books read as a ledger of bid and ask prices at an exchange. The book is sorted with highest bid and lowest ask quotes first, the first line item for each representing the BBO (or NBBO in a composite price book). Each bid and ask includes the order size in shares or 100-share lots and the bank or market maker on the exchange that submitted the order.

The Level 2 order information shows a weighting of bids and asks where volume has accumulated. These points indicate thresholds for supply and demand where sentiment may doubt price movement to surpass. This level of detail is necessary for trading algorithms seeking to forecast liquidity. For example, a focus of bids around a given price may suggest imminent liquidity if a security is anticipated to decrease in price.

How to Get Level 2 Market Data

While real-time Level 1 quotes can be accessed from the Security Information Processor’s (SIP) Consolidated Tape Association (CTA) and Unlisted Trading Privileges (UTP) feeds, depth-of-book quotes are not submitted to the SIP from the exchanges, requiring Level 2 data to be accessed through direct exchange feeds.

Direct feeds are proprietary real-time data streams supplied by exchanges. In US equities, most quotes and trades are through three large exchange families—Intercontinental Exchange Inc.’s NYSE, Nasdaq Inc., and Cboe Global Markets Inc.—and their 11 exchanges. Each exchange offers direct feeds for the order book and top of book quotes, with most offering an aggregated, price-book feed as well.

Fees often vary greatly based on depth of book needed, so seeking cost-efficient options is important to ensure strategy viability and profitability.

Table 2. Direct exchange feeds at each depth of market data.

| NYSE | Nasdaq | Cboe | |

| Last sale | Trades | Last sale | Last sale |

| Top of book | BBO | Basic | Top |

| Price book | Open Book Ultra, Open Book Aggregated | Level 2 | Summary Depth |

| Order book | NYSE Integrated | TotalView | Depth |

Customizing and Consolidating Level 2 Feeds

To account for latency in the SIP feeds, some firms construct their own consolidated book. Instead of the NBBO, market makers or HFTs build a custom best bid and offer (sometimes referred to as a user-based BBO, or UBBO) to view all market liquidity and submit quotes. Similarly, with market depth, a consolidated—or “composite”—price book aggregates the entire market’s liquidity into price levels, illuminating opportunities for order routing.

Market depth and market data infrastructure tend to follow a similar sliding scale of complexity. As feed requirements and quote volume increases, so does the likelihood that its trading environment will require customized hardware and dedicated co-location space. Less market depth is often connected with less latency sensitivity, allowing some brokers or buy-side firms to access data via an API or hosted alternative. Every firm must weigh this decision, but if this article makes you reconsider your strategy’s market depth, request a consultation with an Exegy market data professional to see what’s right for you.

Looking for more insights on how market structure impacts data acquisition and costs in US Equities? Download the guide below or right here.