Intelligent Speed to Profit in Volatile Markets

The coronavirus-induced market volatility has seen the VIX rise to levels not seen since the Great Recession. As the markets nosedived 35.4% from its February 19th high, the VIX rose to 82.69 on March 16. In a recent blog by Exegy’s CEO, Jim O’Donnell noted that a typical trading day sees “two billion changes to the NBBO (National Best Bid and Offer) quotes across the entire U.S. national market system.” The recent highly volatile days have seen the count of NBBO changes doubling to over 4.5 billion per day. Intuitively, the relationship of volatility to the frequency of quotes changing are intertwined.

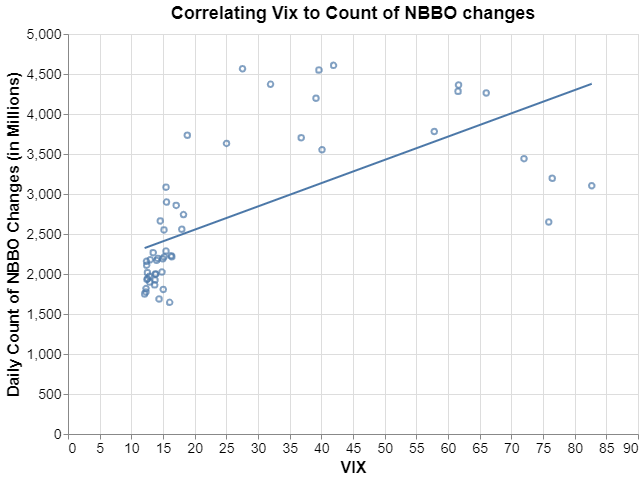

We can quantify the relationship between the VIX and the daily count of NBBO changes to the Pearson correlation of 0.6463. The semi-strong positive correlation is graphed below. We have additionally plotted the year to date on the graph for reference. Notice the “quieter days” represented by the cluster of circles plotted between the VIX values of 10 to 20 with daily counts of NBBO changes mostly below 2.5 billion. Then notice the rising VIX and the corresponding rise in the count of NBBO changes.

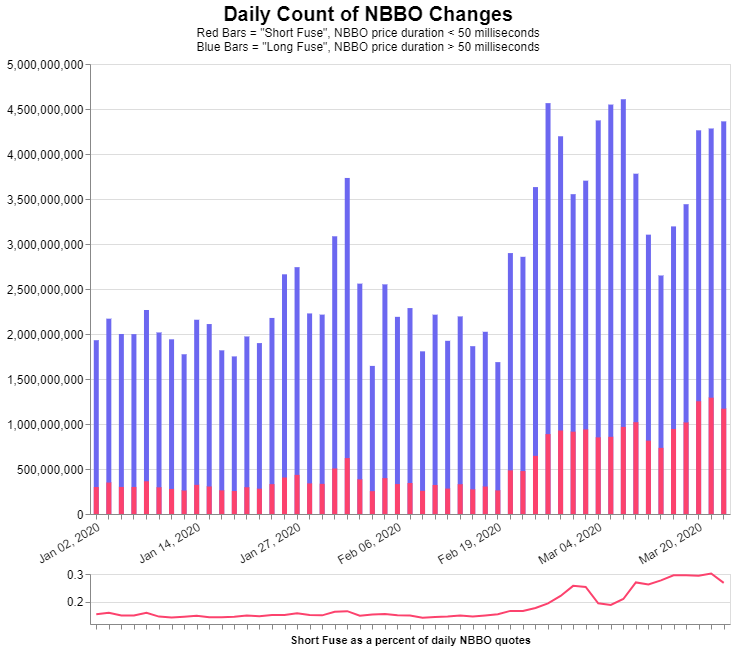

A trader’s ability to revise their quotes quickly will reduce unfavorable mark-outs. But how fast are quotes moving in volatile markets versus non-volatile markets? The chart below shows the proportion of each day’s NBBO quote changes that were fast by the red bars. Signum’s real-time predictor of price duration, Quote Fuse, labels fast (i.e. “short fuse”) quotes as NBBO quotes that have a duration of 50 milliseconds or less before the price changes. (Read the Quote Fuse whitepaper for an explanation of why 50 milliseconds is a useful dividing line.)

The graph shows that 15% to 18% of a typical nonvolatile trading day from January 2020 were fast quotes while the volatile days of March 2020 show that fast quotes comprise over 30% of all quoting activity. Thus, there are twice as many quote changes and twice as many of those quotes are expiring in 50 milliseconds or less. Also, note that the proportion of fast quotes (red bars) tracks closely to the daily closing value of the VIX. The chart below shows a side by side comparison: the left side shows the daily proportion of NBBO quote changes that were fast, and the right chart shows the daily closing value of the VIX index. The two charts are remarkably similar in shape.

Now we plot the VIX directly against the proportion of fast quotes in the chart below. The correlation is a remarkably high 0.9557! We dare say that knowing the proportion of fast quotes is a strong indication of volatility in the markets.

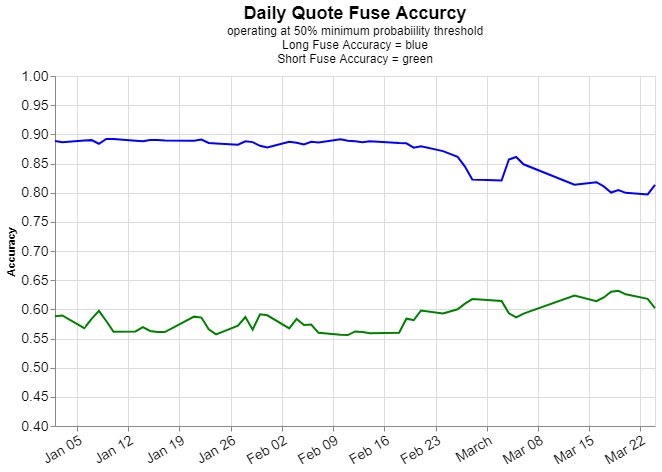

Finally, we assess how volatility impacts the accuracy of Quote Fuse’s predictions of NBBO price stability. As shown in the chart below, the accuracy of Quote Fuse in predicting fast (“short fuse”) quotes improved slightly as volatility increased. Note that the line chart below plots the accuracy of both long fuse and short fuse accuracy as blue and green lines, respectively. We are delighted to add a “real-time indication of volatility” to the list of uses for our Quote Fuse signal.

As we highlight in the whitepaper, Quote Fuse is useful for both speed-dependent trading algorithms, as well as strategies with lower turnover that seek to eliminate slippage and optimize execution quality when they do enter and leave positions. For the speedy traders, such as market makers, Quote Fuse allows algorithms to anticipate imminent NBBO changes, rather than react to them. By doing so, they can gain a more favorable queue position when repricing quotes and win more opportunities to grab a slice of the spread. Less speed-sensitive strategies are still sensitive to execution quality. Slippage erodes returns, even when you trade less frequently (but perhaps in larger sizes). Quote Fuse can help execution algorithms avoid “stale” quotes – quotes that expire while orders are en route to the exchange(s). Without this ability, traders may resort to aggressively crossing spreads to get filled. Worse yet, those spreads can widen dramatically in volatile markets.

In summary, we find that Quote Fuse to be an invaluable tool for navigating volatile markets for a wide variety of market participants. With accurate predictions of the duration of NBBO quotes, delivered with EVERY new NBBO quote in less than a microsecond, you can:

- Avoid chasing stale quotes

- Reprice and maneuver limit orders (to gain better queue position and let the market chase after you)

- Deploy tactical strategies to sweep liquidity when stable (“long fuse”) NBBO prices are indicated

- Cross the spread only when it’s to your advantage

We invite you to test our claims. Review our whitepapers, request a sample of our demo data, and contact us to learn more.