Hiding (and Seeking) Liquidity With Iceberg Orders

Iceberg orders are a substantial source of liquidity on major US exchanges, making up anywhere from 3% to 8% of the total volume on a given exchange.

Institutional investors rely on them to trade large blocks of securities without costly information leakage that could move the market against them.

The liquidity created by iceberg orders provides opportunities for firms—if they can detect them in time to act before the orders are absorbed by the market. Algorithms can aid in that goal, by interpreting patterns of market data to reveal the existence of an iceberg in real time and to signal the opportunity for immediate action.

Iceberg Orders—What They Are and How They’re Used

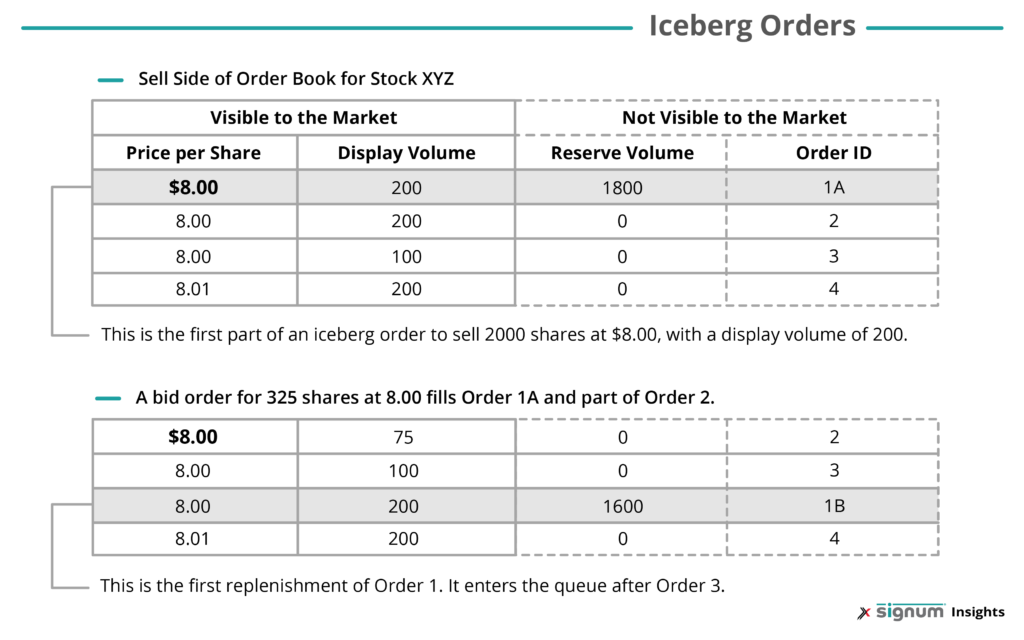

The term “iceberg” refers to the common description of icebergs as having much larger volume beneath the surface than the visible area would indicate. Iceberg orders, also called reserve orders, are a type of limit order used by institutional market participants to execute large-volume trades inconspicuously. An iceberg order type splits up a large order, displaying a piece of it on the limit book, while holding back a large undisplayed reserve. As the smaller order is executed, another is pulled from the reserve and appears on the book.

Other traders would only see an order of typical size rise to the top of the book, get executed, and then a similar order of typical size would pop up again at the end of the queue.

The smaller orders have no visible attributes linking them to the iceberg order. Its full magnitude is not shown to the market and cannot be known unless the entire trade is executed and the sizes of the pieces added together.

For firms wishing to execute orders of thousands of shares, iceberg orders help them reduce the risk of telegraphing their intent, which could cause the price of a stock to move unfavorably. Iceberg orders can also allow firms to mask larger strategies from brokers by directly executing them through the exchange. This mitigates another source of information leakage for institutional traders.

For other market participants, learning where iceberg orders are lurking can provide substantial benefits. The large orders create a reservoir of liquidity allowing firms to trade in larger sizes with less slippage, which aids in best execution. As a result, iceberg orders attract additional trading activity at the top of the book when market participants identify and target the orders and other participants interact with the increased order flow.

Hiding—and Seeking—Icebergs

Most major exchanges provide a mechanism for submitting an iceberg order and controlling its execution. For example, a “max floor” parameter defines the largest slice of the iceberg order that can be displayed at any given time. A firm can choose how quickly to replenish an order from the reserve (including before the previous order has been completely executed) and can randomize the sizes of orders to further conceal the larger iceberg order.

A firm can also submit a “synthetic” iceberg order, in which a broker or trading platform divides the main order and submits the smaller orders to the exchange. This method is sometimes used when firms submit to exchanges such as CME Group, which clearly labels exchange-generated iceberg orders.

Despite all these methods of obscuring iceberg orders, they can be tracked by detecting patterns created by the systematic replenishment of liquidity. This requires order-level market data (market-by-order, sometimes called Level 3)—granular market data that shows the number of orders for a security at each price level, along with the size of each order.

One sign of a resting iceberg order is when a trade executes at a higher volume than the displayed liquidity at the top of the book (i.e. at the best price). For example, the current best offer may show availability of 375 shares of a stock. There is a subsequent trade for 450 shares, but the next quote update doesn’t show a changed price. The transaction in this case is clearly tapping hidden liquidity, which is replenishing the displayed order instantly at the original price.

As orders continue to be filled, incoming replenishments provide support for that best price, which will not change until the reserve is exhausted. The timing of the new orders helps establish that they are replenishments, since they’re executed before the price has a chance to change.

Reacting to an Iceberg Order

Other evidence of iceberg orders can be more subtle, which can make identification more difficult. But firms in search of liquidity have found that it’s worth the effort to crack the code, or to use a signals service that does it for them.

Once they have that knowledge in hand, they can set their own trading algorithms to respond.

For example, a liquidity-seeking algorithmic trader who wants to execute a large trade can be alerted via a signal that a particular venue has more liquidity in a stock than is currently displayed. That would allow the trader to operate more aggressively on that exchange with less risk. If the trader’s signals provide sufficient tracking of iceberg orders, algorithms can target multiple levels of a price book with larger size.

Another firm might use the signals in conjunction with a Smart Order Router (SOR) application, setting it to identify venues where hidden liquidity has been detected. The SOR application can choose to slice orders into larger sizes and make routing decisions based on those estimates to improve fill rates, reduce slippage, and enhance execution quality.

Buying versus Building an Iceberg Detector

The potential benefits from leveraging information about icebergs has spurred efforts throughout the industry to develop ways to detect them. But it’s not a simple process. Each exchange displays the replenishment of an iceberg order differently, so a single mechanism can’t find hidden liquidity on every exchange. Detection of iceberg orders must be fine-tuned for each exchange’s unique method.

Firms that have worked out methods of detecting icebergs keep those methods closely held. Development of a signal can take years of work and significant financial investment. Until recently, buying an accurate iceberg detection signal was not possible.

Exegy developed Liquidity Lamp, an iceberg order detection and tracking signal, as part of its ongoing efforts to understand market “nano-structure”–the mechanics of electronic markets as reflected in raw market data feeds. The signal highlights orders that are part of an iceberg order, immediately flagging replenishments when they appear in the queue. Indications of hidden liquidity are also presented in higher-level summary views of market data, including market-by-price books (Level 2) and top-of-book quotes (Level 1). Subscribers of Liquidity Lamp can track the full life cycle of reserve orders throughout the price book, including situations in which multiple reserve orders exist at various price levels simultaneously.

Liquidity Lamp is one of a suite of trading signals that make up Exegy’s signals-as-a-service offering, Signum. The signals are integrated with Exegy’s line of real-time market data solutions, appearing as extra fields through our client API.

Signum can play various roles in a firm’s trading, depending on its goals. Sell-side firms can use Signum to add AI-driven signals to their execution algorithms and ATS order types faster and more cheaply than building their own data science team. Proprietary traders may use Signum in concert with other in-house signals to create sophisticated algorithms for more in-depth strategies. To learn more about Liquidity Lamp, read our whitepaper and request demo data. For more information about how Signum can help in the detection and leveraging of iceberg orders, contact us today.

Want to know more about Liquidity Lamp? Learn how its summary data can be used with machine learning to create alpha cloning strategies.