ETFs Provide Stability and Liquidity in Volatile Markets

With pandemic-triggered volatility roiling the markets in 2020, ETFs overcame long-time concerns about their performance in volatile markets. They proved to be a stable use case for risk management, hedging, and price discovery, particularly for illiquid assets such as bonds.

A record USD 507.4 billion flowed into US-listed ETFs during 2020, up 55% from 2019’s inflows. For the second straight year, fixed income ETFs led all other asset classes, bringing in USD 186.4 billion in new investment.

Technology has helped ETF providers and authorized participants weather the volatility pressure. Basket calculation engines, in particular, have enhanced the creation/redemption process by allowing high-speed calculations of the net asset value (NAV) of baskets of securities, which helps firms keep pace with volatile markets. To prepare your firm for the next bout of volatility, contact us.

ETFs Show Their Strength During 2020’s Wild Ride

As we’ve noted before, the events of 2020—particularly the effects of the initial spread of the coronavirus—had a dramatic impact on market volatility. In the US markets, market-wide circuit breakers were triggered four times in March because of 7% drops in the S&P 500, the first time that circuit breakers had been applied since 1997.

On March 16, the Cboe Volatility Index (also known as the VIX, it measures implied volatility based on options positions on the S&P 500) hit an all-time high close of 82.69, and its March 18 intraday high of 85.47 is second only to Oct. 24, 2008, during the height of the 2008-2009 financial crisis. Volatility continued to remain above normal throughout 2020, ramping up again in advance of the 2020 US elections. The VIX ended the year at 22.75, up 65% over Dec. 31, 2019.

For years, there had been concerns that volatile markets such as those experienced in 2020 could cause problems for exchange-traded funds. ETFs’ unique structure is balanced on two markets—the primary market of ETF providers and authorized participants, who create and redeem shares, and the secondary market of individual investors, who trade the shares on exchanges like other securities. That balance is maintained through an arbitrage process that incentivizes share creations and redemptions to align the share price with its net asset value (NAV).

The worry was that during substantial market changes, the difference in liquidity between the two markets could lead those two values to diverge wildly and quickly, magnifying the effects of changes to the prices of underlying securities.

Although volatility did lead to larger-than-normal divergence between the two markets, it appears that ETFs carried out an important role in regaining equilibrium, providing liquidity and price discovery in situations where the underlying markets could not. For example, on March 9 and 12, while US equities futures trading was halted, ETFs tracking the S&P 500 continued to trade. The subsequent changes in ETF share prices were very close to where the index ended up when the markets reopened.

The stabilizing effect of ETFs was especially pronounced in the fixed income market, which saw periods in March when bond liquidity was severely impaired. When prices did diverge from the NAV, overall, bond ETFs were seen as a stronger indicator of value than the underlying bonds, which were traded much more thinly in a more fragmented market.

This held true for corporate bond ETFs, as well as sovereign bond funds. BlackRock, one of the largest ETF providers, noted that for US Treasuries (generally considered a very deep and liquid market), the bid-ask spreads on the largest ETFs averaged from 1-3 basis points, while the spreads for the underlying bonds on the same dates could be more than 20 times wider.

Technology Helps APs Participate in the Primary Market during Volatile Periods

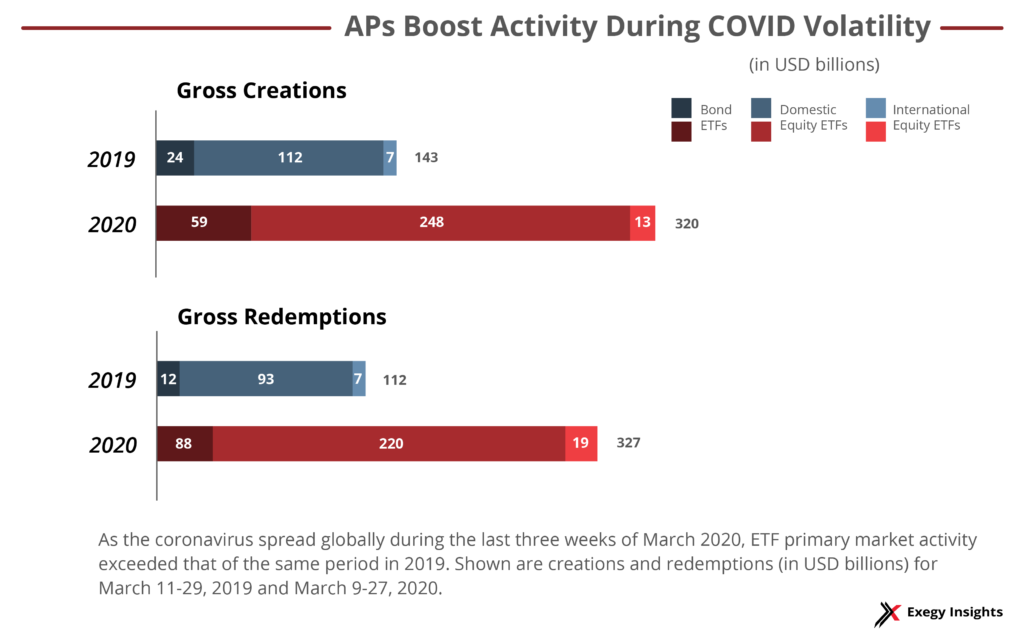

Before 2020’s stressed financial markets, some policymakers worried that volatility could cause authorized participants (APs) to relinquish their role in the creation/redemption process that underpins the ETF market. But this concern wasn’t borne out by the COVID crisis. A survey conducted by the Investment Company Institute found that APs engaged in significantly more primary market activity during the last three weeks of March (the early weeks of the pandemic’s global spread) than they did during the same period in March 2019. This held true across domestic and international equity ETFs, as well as bond ETFs.

APs can be assisted by technologies that make it possible to track split-second changes in the NAVs of ETF baskets, which can contain hundreds of individual securities. Basket calculation engines such as the one found in Exegy’s Ticker Plant can compute NAVs in a few hundred nanoseconds to assist APs in the ETF arbitrage process, updating each time a constituent security is repriced. This allows ETFs to operate smoothly in volatile markets, despite the increased volume.

As we noted before, the extremely volatile trading of early March kept data flowing at high rates that didn’t necessarily follow a traditional pattern (a high-volume open, then moderate activity throughout the session and a high-volume close). Market data rates, as measured by Exegy appliances, were elevated for most of the trading day—performing at maximum capacity for as much as 70 percent of the day. This strains infrastructure capacity. But Exegy’s customers reported flawless functioning during even the highest volatility.

In addition to basket calculation, participants in the ETF bond primary market can also use portfolio trading mechanisms to price a basket of hundreds of bonds, negotiate with multiple dealers and execute the trade all at once. This can greatly enhance creation/redemption in the fixed income ETF arena. Exegy currently helps enable firms’ fixed income ETF strategies by providing access to a number of fixed income market data feeds. As more of these feeds become available, we will expand our clients’ entry to the bond ETF ecosystem.

Unanswered Questions about ETFs and Volatility

While ETFs may have passed this test of their resilience, questions remain about how they respond to and potentially affect volatility.

Leveraged and inverse ETFs proved popular during 2020, ending the year with USD 56.2 billion in AUM, up 8.8 percent from the end of 2019. L&I funds are constructed with the goal of delivering some multiple (leveraged) or opposite (inverse) result of an underlying index.

Because of their structure, they can cause sudden large losses, and if a fund loses enough value it can be forced to shut down. More than three dozen L&I funds shut down during 2020 in response to volatile markets. There’s also concern about their use by inexperienced investors. The funds are designed to deliver their leveraged and inverse results over a short period, often as briefly as a day. However, studies show that many investors can hold them for months, leading to extreme risk of negative returns during periods of high volatility.

In October 2020, the Securities and Exchange Commission took steps to rein in leveraged and inverse funds, including requiring them to implement risk management plans.

More broadly, some experts have argued that the exchange-traded fund structure inherently magnifies volatility, as ETFs put price pressure on the underlying securities. A study has shown that stocks with higher ownership by ETFs experience more volatility.

Nevertheless, ETFs have established themselves as a vital addition to the toolbox of institutional investors, and firms wishing to prepare themselves for future volatile periods must ensure their infrastructure can handle the magnitude of market data required to effectively use them. To learn more about how Exegy’s line of appliances can keep your basket calculations on pace with fast-moving ETF markets, contact us for an overview and evaluation of how Exegy can add value to your participation in the ETF category.