The Consolidated Tape: Get to Know NYSE’s CTA Feeds

The Consolidated Tape Association’s (CTA’s) trade and quote feeds are an affordable source of top-of-book market data. While the exchanges’ direct feeds may deliver data faster and in greater detail, the CTA’s feeds serve of a variety of market participants at a lower cost. Online resources about the consolidated tape range from brief overviews to the CTA’s official specifications. So, this article serves as a complimentary middle ground—offering clarifying details and explaining costs in a quick and easy format.

The CTA’s Consolidated Tape System and Consolidated Quote System

The CTA is one of two Security Information Processors (SIPs) for US equities. It disseminates trades and quotes from securities listed on the New York Stock Exchange (NYSE) as well as those listed on a number of other exchanges – NYSE Arca, NYSE American, NYSE Chicago, IEX, and Cboe’s BYX, BZX, EDGA and EDGX. The market data is distributed on two networks—Tape A and Tape B—NYSE’s listings on the former and the rest of the exchanges listed on the latter.

For each tape, the CTA provides two feeds. The Consolidated Quotation System (CQS) provides quotes and calculates a National Best Bid and Offer (NBBO). The Consolidated Tape System (CTS) disseminates trade – or last sale – data from exchanges. The feeds gather market data about these securities not just from their listed exchanges, but from any exchange regulated by the U.S. Securities and Exchange Commission (SEC) on which they are traded.

The Securities Industry Automation Corporation (SIAC), which is owned and provisioned by NYSE, operates and maintains the infrastructure that collects the trade and quote data and disseminates it via the four feeds. SIAC may be familiar to options traders, as it provides the same services to the options SIP, the Options Price Reporting Authority (OPRA).

The SIP Feeds and the National Market System Plan

NYSE’s CTA Plan is part of the SEC’s Regulation National Market System (Reg NMS), which aims to protect investors and improve national markets’ efficiency. Reg NMS requires orders on protected markets to be matched at the designated NBBO. Further, market data accessibility is simplified by the designated SIPs that create a one-stop shop for all exchanges’ best bid and offers.

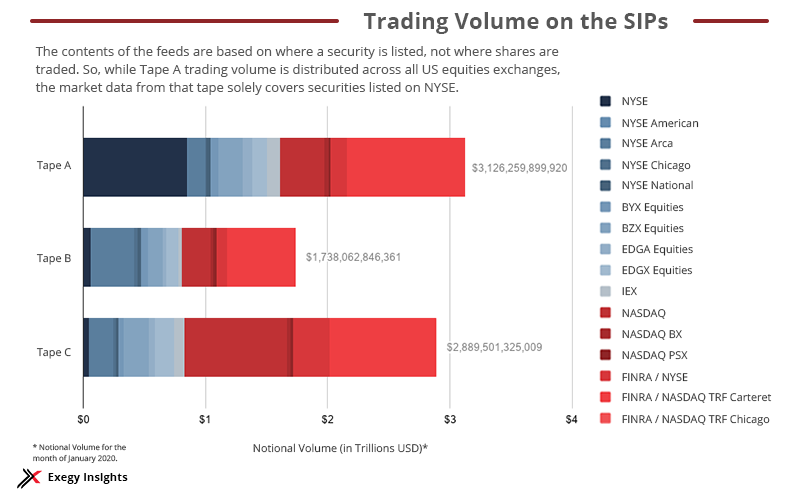

The CTA arrangement is similar to the Unlisted Trading Privileges’ (UTP’s) quote and trade feeds, designated by Nasdaq (also referred to as Tape C). The contents of each feed are based on where a particular security is listed, so traders who need data on all US-listed securities would require access to all six of the CTA’s and UTP’s feeds.

Market Depth and Latency

The CQS and CTS feeds are designated as Level 1 or top-of-book, since they don’t include information about any orders at price levels other than the BBO of each exchange.

While full-depth order book views provide useful information, SIP feeds can satisfy trading applications that don’t require market depth, such as display trading. The SIP data also works well for supporting applications such as pre-trade risk and regulatory compliance checks. However, the consolidated tape may lack the granularity needed for algorithmic trading or large orders that sweep multiple levels of the book.

The latency of the CTA feeds has improved in recent years, falling to a median latency of 61 µs for quotes and 64 µs for trades in the third quarter of 2019. Its delivery is still slower than that of the proprietary direct feeds available from the major exchanges, so traders who require the lowest possible latency will need more direct access.

Fees for CTA Feeds

Since market data is one of a trading firm’s largest expenses, you need to understand the fees assessed by the exchanges for accessing the data. Here’s a basic comparison of the fees associated with the CTA and UTP feeds, as well as the total cost of accessing both, since, combining them gives the full picture of U.S. securities.

Table 1. Market data fees for CTA and UTP networks (All rates are monthly)

| Mode of access | Application | ||||

| Network /Tape | Co-location /Direct Access | Feed or Internet /Indirect Access | Non-Display | Redistribution | Display (per 20 devices) |

| CTA (Tape A &Tape B) | 5,000 | 3,000 | 6,000 | 2,000 | 576 |

| UTP (Tape C) | 2,500 | 500 | 3,500 | 1,000 | 460 |

| TOTAL | 7,500 | 3,500 | 9,500 | 3,000 | 1,036 |

For a firm using 20 terminals or trading displays, the monthly fees for CTA feeds run $576, plus $3,000 for indirect access. Without a terminal or display need (for, say, algorithmic trading), an alternative $6,000 fee is charged for each non-display application, so the total cost of access for that application would range from $9,000 to $11,000.

By comparison, the access and non-display fees of the NYSE and Cboe exchange families total $16,500 and $44,500, respectively. However, the added fees also come with lower latency and greater market depth.

It should be noted that the four CTA feeds account for a greater capacity of data than the two UTP feeds, which helps explain their higher fees. For the third quarter of 2019, the UTP’s Quotation Data Feed (UQDF) reported an average peak of about 362,000 quotes per second, while the CQS reported 958,000 quotes per second. While these statistics reflect peaks and not averages, they’re evidence of CTA’s scope.

How to Access CTA Feeds

In choosing how to receive the CQS and CTS feeds, consider how you’ll be using the data, the amount of data you need, and how much control you want to maintain over its transmission. All of these factors help determine what kind of market data vendor is required.

A feed provider sells access to normalized market data feeds via an API and skips the need for infrastructure to gather data and process it. Feed providers also serve as an intermediary to exchanges driving down access fees from direct to indirect access and saving SIP traders $4,000 each month. It’s an ideal solution for affordable access.

For display trading, execution and order management systems (EOMS) are the tool of choice. However, you’re limited to a vendor’s visualizations and charts, so research how your trading team will use the software to confirm what tool will serve them best. Since it only provides the information in a visual format, it won’t work for algorithmic trading.

Many broker-dealers will find that an API or trading software will suffice for trading with the SIPs, but direct feeds may require a greater infrastructure investment.

The Consolidated Quote System and Consolidated Tape System feeds are just one piece of the total equities picture – but one that is well-matched to the needs of many traders. Understanding how the feeds work can help you see where they fit into your organization’s market data needs.