Getting Started with Calendar Spreads in Futures

Calendar spreads are a valued derivatives product type for a variety of strategies. They hedge against systematic risk but additionally, they ensure continued market exposure and can serve as a vehicle for generating alpha. The risk profile of futures calendar spreads differs from options, warranting clarification. This article overviews the basics, the risks and profitability potential, and introduces the market data needs to get started.

Calendar Spreads in Futures

Calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Since they maintain the same strike price and contract specs, calendar spreads aren’t impacted by the volatility of the outright contracts’ pricing. Instead, price action is influenced by fundamental factors of supply and demand. Seasonality, geopolitical events, and weather may forecast shortages or surpluses that alter the spread price.

Calendar spreads are commonly referred to as time spreads. However, they’re also called:

1. Horizontal spreads, for their inverse relationship to vertical spreads that vary on strike price.

2. Intra-market spreads, since the product, or “market,” of the legs match.

3. Inter-delivery spreads, due to the varying deliveries of multiple expiration dates.

Calendar spreads specifically describe an product type; however, they may also refer to a calendar spread trading strategy that is accomplished by legging in. In futures, an order for a calendar spread is a separate product from the individual products. For example, the /ESZ9-ESH0 product is priced on the differential of December 2019 (/ESZ9) and March 2020 (/ESH0) e-mini contracts for the S&P 500 index. Similarly, a trader with market exposure on the /ESZ9 December contract could “leg in”—take another position to create a combined overall position—to the same calendar spread by taking an opposing position on /ESH0.

While a legged-in position provides the risk aversity of a calendar spread with the flexibility of executing the legs, the exchange’s spread products offer reduced margin requirements and reduced risk of slippage. Since the two positions are captured simultaneously, the chance for harmful price action on the second leg is eliminated. Further, the lower risk of spreads has led exchanges to offer margin credits, requiring less capital to maintain a position.

How Calendar Spreads are Priced

Usually, the price of the deferred contract is higher than that of the near-term contract due to the cost of carry—the costs of insurance, interest, storage and generally, holding the underlying asset. This condition, known as contango, occurs when no extraneous variables drive up the price of a near-term contract. However, when geopolitical events or weather create near-term shortages, the decreased ratio of supply to demand can increase the near-term contract value into a scenario of backwardation.

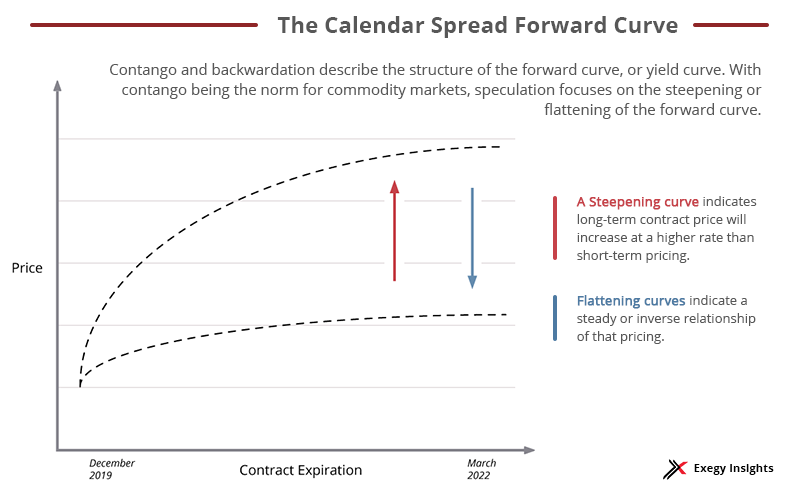

Contango and backwardation describe the structure of the forward curve, also called the yield curve when discussing interest rates. With contango being the norm for commodity markets, speculation focuses on the steepening or flattening of the forward curve. Changes in short-term supply and demand can increase or decrease the forward curve’s slope and affect the differential of the spread. Anticipating seasonality, production trends, and global news can account for fluctuation in slope and profitability of each leg in the spread.

While futures calendar spreads are relatively low risk products, they are not immune to losses. Payoff in the spread doesn’t come from price movement, but rather, the slope of the forward curve.

How Futures Traders use Calendar Spreads

Futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Maintaining market exposure and retaining competitive pricing on a physical position are accomplished more easily with time spreads. However, alpha generation is still popular, particularly with financial products.

With currencies and interest rates, traders not only hedge the risk those pose to their portfolio, traders also can profit on how the yield curve changes over time. A steepening curve indicates long-term rates will increase at a higher rate than short-term rates, while flattening curves indicate a steady or inverse relationship of those rates.

In addition, the delineation of spread and outright futures products introduces the opportunity for arbitrage with ultra-low latency trading. The bid-ask spread is often narrower on the calendar spread product, creating a risk-free trade for expedient algorithms to trade the underlying futures contract.

Market Data for Futures Spreads

With legging in and the implied market, the CME Group affords a good deal of flexibility to ensure sufficient liquidity on calendar spreads. However, this flexibility makes market data fluency critical to trading success.

For the standard calendar spread order type, traders can define the contract specs of a new spread product. Also called a user-defined spread, these new products define the expirations of each leg and the ratio of contracts per leg. This drives the importance of reference data for calendar spreads more so than other order types in futures.

In addition, the CME Group facilitates an implied market between the spread and outright contracts to improve order matching. Implied markets derive prices and matches orders across spread and outright contracts. However, an order executed as implied orders do not appear in the book until the trade is executed. For those seeking liquidity for spreads and seeking to avoid getting picked off, visibility to both products is essential.

Understanding the nuances of calendar spread products is the first step to incorporating them into your trade strategy. Although CME Group distributes spread tick data on the same feed as outright contracts, their feeds are divided into channels. To ensure insights aren’t lost, a market data vendor must understand the interaction of channels dedicated to tick and reference data and maintain a robust feed handler to accommodate the various data streams. To avoid a piecemeal of market data feeds, seek providers that don’t trim data from their feeds.

After more than a decade of helping enterprise banks and hedge funds manage their market data infrastructures, Exegy understands the growing market data needs of the industry. With an evolving product suite that includes the Metro trading platform and the cost-efficient and real-time feed, Axiom, we enable firms to access their needed feeds and source their trading solutions from one vendor. To learn how Exegy can support your futures and global market data needs, request a consultation.