BBO Trading App

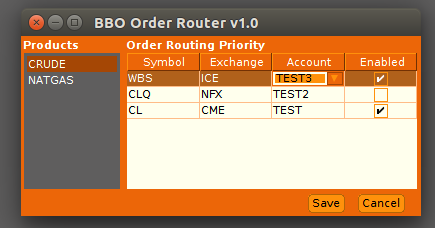

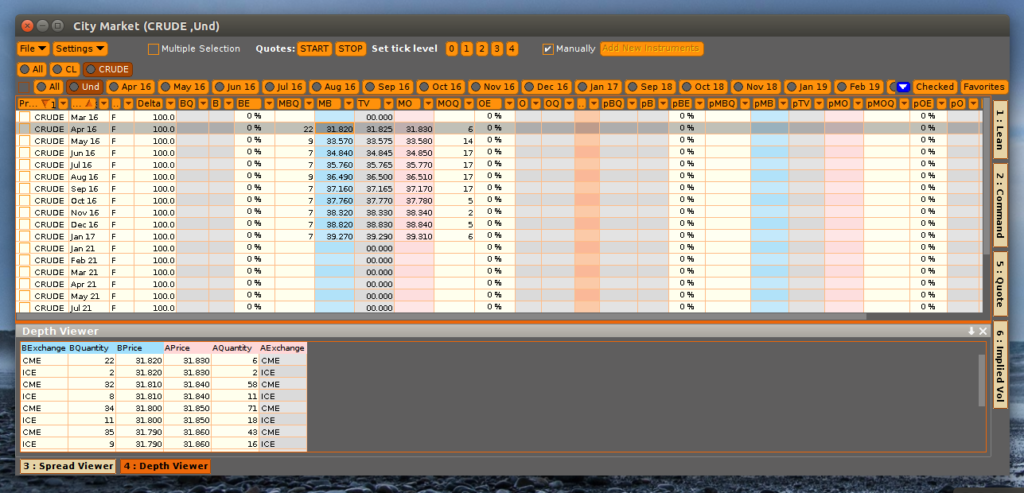

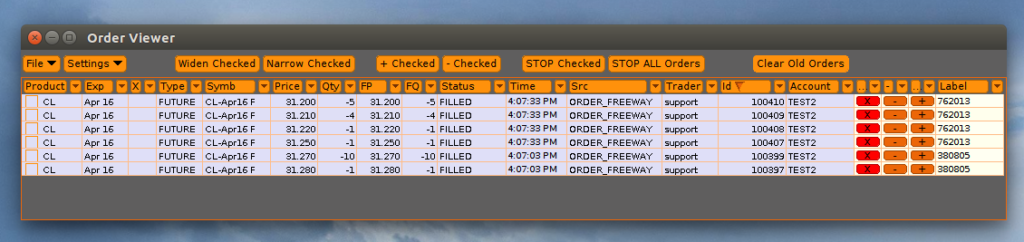

With the introduction of the NASDAQ Futures exchange, there are now 3 different commodity exchanges that list energy products. These are CME, ICE and now Nasdaq Futures (NFX). The BBO Order Router facilitates trading between these 3 commodity exchanges by allowing the trader to trade, with 1 order, across all 3 different exchanges (or 2 if that’s what they’ve configured). This type of “Sweep” order is typically used in equity markets when traders have an opinion on volatility, allow the trader to take out a significant amount of volume at a certain vol level. When Sweep Orders are placed it’s also possible that the trader can buy or sell vol across a few different strikes.

The user has the ability to setup exchange priorities for each product (Eg. CRUDE) and can also disable an exchange on a per product basis. Users can also select a specific trading account for orders to an exchange per product.

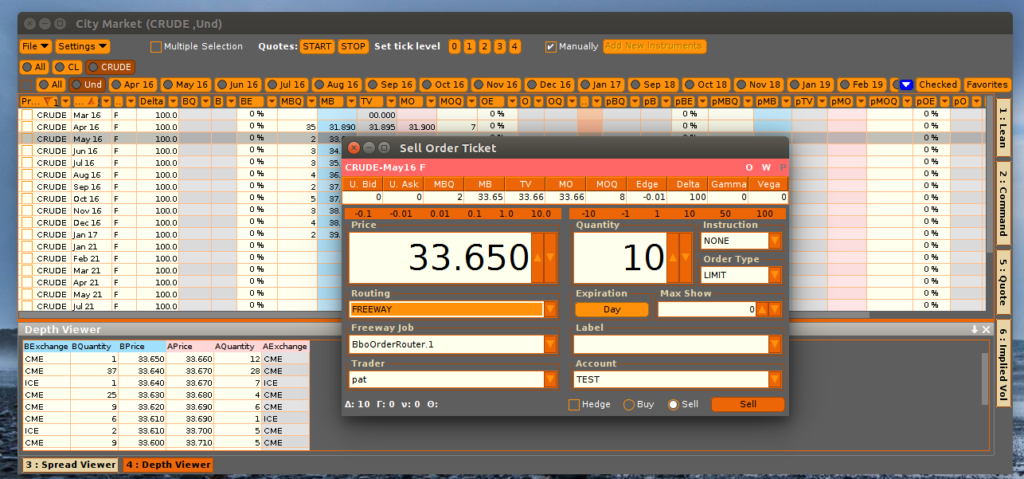

Note that this widget needs Metro v6.1. It is not meant to replace City Market or the Order Viewer, but instead extends its functionality on the back end with smart order placement. For this version, only MARKET and LIMIT orders are supported.

Remember that in Metro NOW, dashboards and widgets can be utilized in both OnRamp and Metro clients.

Related Resources

Exegy Supports BMLL’s Recent Addition of Historical US OPRA Options Data

London, New York, 27 March 2025: BMLL Technologies (BMLL), the leading, independent provider of harmonised, Level 3, 2 and 1 historical data and analytics to the world’s financial markets, and…

CEO of Exegy Named Chief Executive of the Year for Leadership in Derivatives Technology

St. Louis, New York, London – February 18th, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, is pleased to announce that its…

Exegy Hires Industry Vet, Fiesel, to Build on Sales Momentum

St. Louis, New York – 9 January 2025 – Exegy, the leading provider of market data and trading technology for capital markets across the latency spectrum, is pleased to announce…