BBBY’s stock Explained with Institutional Order Flow

The challenge of following so-called “meme stocks” is separating the hype from the reality. Last week’s roller coaster ride for the price of home goods retailer Bed Bath & Beyond (BBBY) is a textbook example of that dilemma. It’s also a striking example of Exegy’s predictive signals cutting through the noise, showing what institutional investors are really doing compared with retail investors.

Enthusiasm built about BBBY, based on rumors of bullishness by GameStop Chairman Ryan Cohen. An SEC filing on Monday, Aug. 15, showed that Cohen’s venture capital firm, RC Ventures LLC, bought out-of-the-money call options on 1.67 million shares of the company with strike prices as high as $80. This indicated to eager retail traders that Cohen anticipated a rise in BBBY’s price, which closed at $16.00 on Aug. 15.

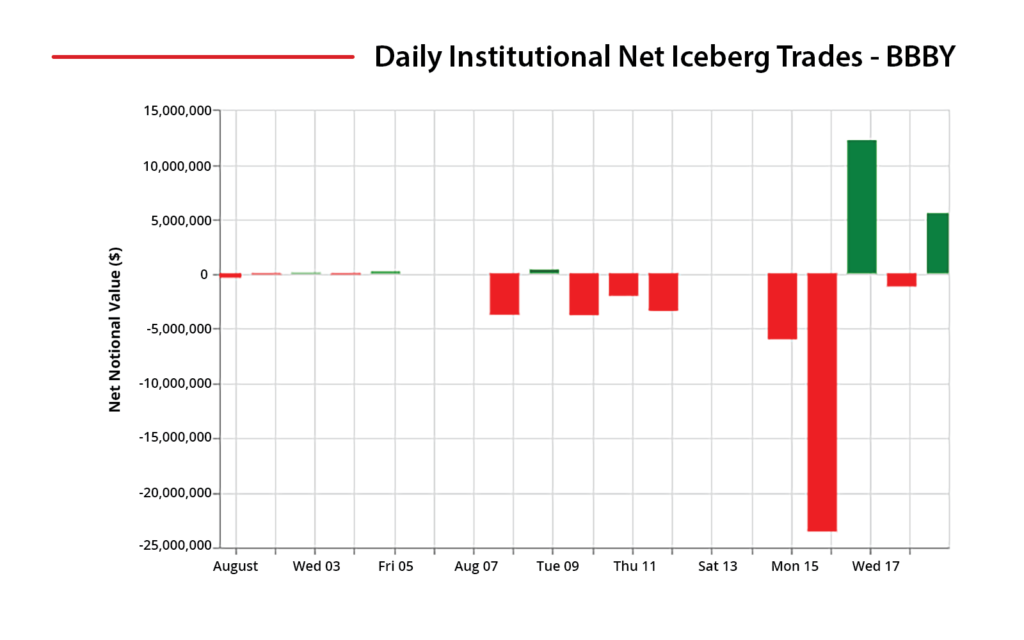

But Exegy’s predictive signals, one of which detects reserve or “iceberg order” activity, showed a disquieting alternate viewpoint: Sharp institutional selling behind the scenes, even as the price of BBBY skyrocketed more than 70% to an intraday high of $28.04 on Tuesday, Aug. 16. On that same day, institutional investors net sold $23.5 million in BBBY stock using iceberg orders.

On Thursday, a new SEC filing showed that Cohen shared in the selling, unloading 5 million shares on Aug. 16, at prices ranging from $18.68 to $26.27.

Eventually, all that institutional skepticism caught up to BBBY: its price dropped to $10.88 by the opening bell on Friday, Aug. 19, and it finished the week at $11.03 or a 63% fall from mania-fueled high price of $30.00 Aug 17.

While the rise of the retail investor has transformed the markets, institutional money still exerts powerful influence. Getting a window into the activity of the most informed large investors can keep your firm’s hands and feet inside the ride, even during a wild week like this one. For more information about how Exegy’s predictive signals can inform your trading, contact us.

To learn more about Exegy’s signal that tracks reserve order activity, click here.