Advanced Order App

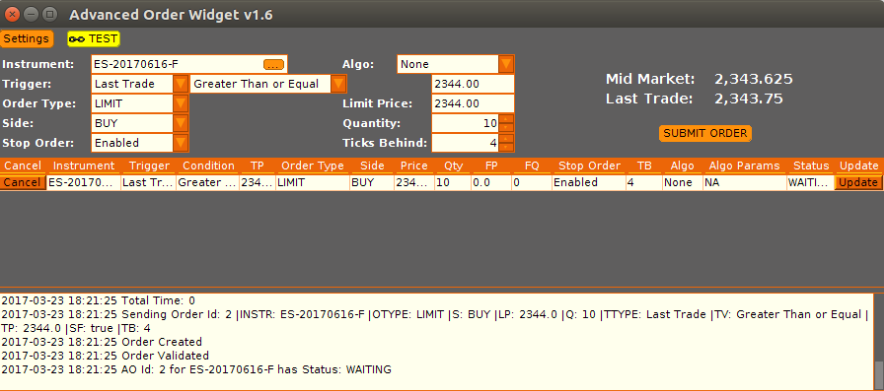

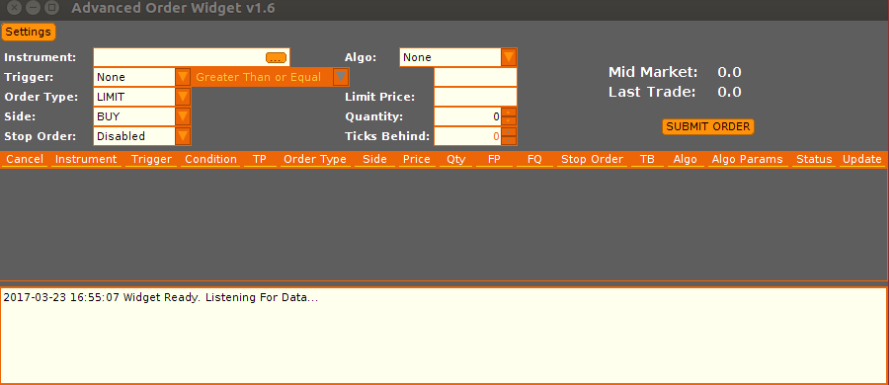

The Advanced Order App allows futures and options traders to place complex orders that cannot be done using just exchange-supported logic. Users can place limit or market orders as well as place contingent stop loss orders at a user-determined number of ticks behind the executed price of that order.

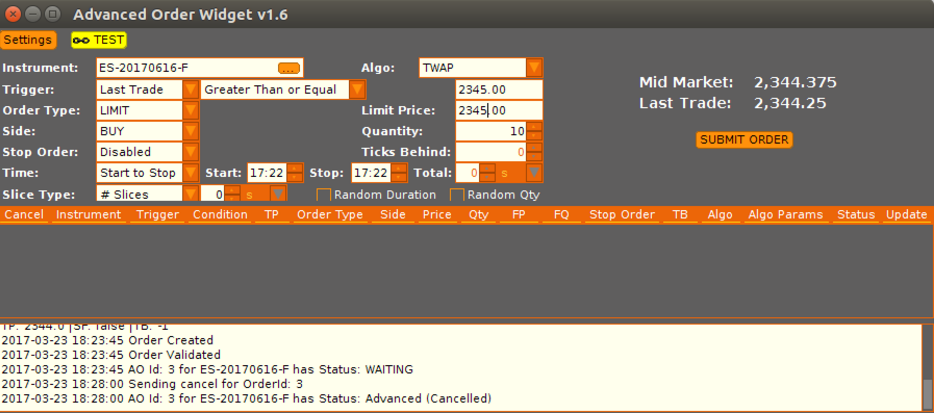

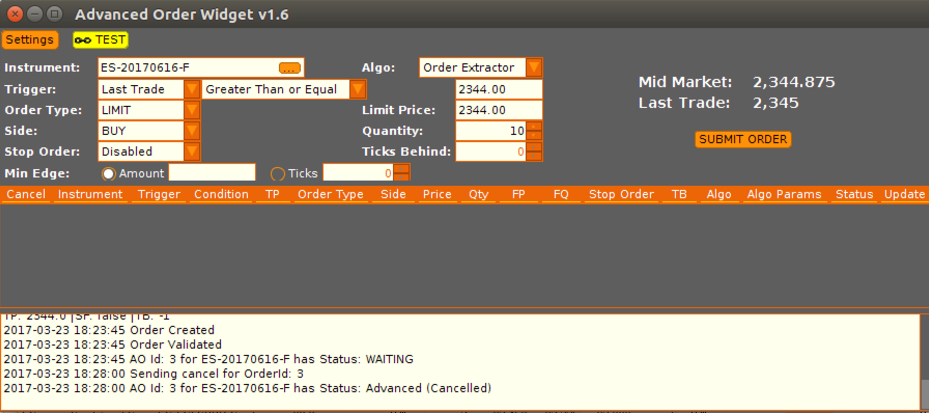

The app has been popular with Metro customers since it launched as it allows for futures orders to be submitted based on triggers such as last trade or mid-market price. The Exegy development team has incorporated customer feedback and rolled out a newer version of the app which now allows for algo-driven orders such as TWAP (Time Weighted Average Price) orders. These orders allow the trader to set time frames for submitting orders, including time between orders and randomizing the quantity for each order. In addition, traders can now extend orders beyond close of day and keep orders active for multiple days.

The Advanced Order App also allows for user-defined class settings such as price factors for each product for additional customization. The app allows for quick in-line editing of orders within the order viewer so orders can be updated rapidly once placed. Our development team continues to improve the app and will be adding VWAP (Volume Weighted Average Price) orders in the near future.

Related Resources

Exegy Supports BMLL’s Recent Addition of Historical US OPRA Options Data

London, New York, 27 March 2025: BMLL Technologies (BMLL), the leading, independent provider of harmonised, Level 3, 2 and 1 historical data and analytics to the world’s financial markets, and…

CEO of Exegy Named Chief Executive of the Year for Leadership in Derivatives Technology

St. Louis, New York, London – February 18th, 2025 – Exegy, a leading provider of market data and trading technology for the capital markets, is pleased to announce that its…

Exegy Hires Industry Vet, Fiesel, to Build on Sales Momentum

St. Louis, New York – 9 January 2025 – Exegy, the leading provider of market data and trading technology for capital markets across the latency spectrum, is pleased to announce…