Accessing Real-Time Futures Market Data

Unlike US equities or other fragmented markets, the US futures market maintains relatively centralized liquidity. Since futures contract specifications are unique to each exchange, traders must close their position on the same exchange that positions are opened. This has caused much of the consolidation in futures trading and has simplified the market data buying process. Still, whether you seek futures market data for pre-market trading or as a hedging solution, understanding the market structure will ensure you’ve defined feed set requirements.

What Exchanges Provide Futures Market Data?

The Juggernaut of Futures Market Data: CME Group

Deciding your futures market data needs is based on two main factors – where you can source sufficient liquidity and where you can access the contracts your trading team seeks. For futures, CME Group is the incumbent, with four exchanges handling 93% of the market’s traded contract volume.

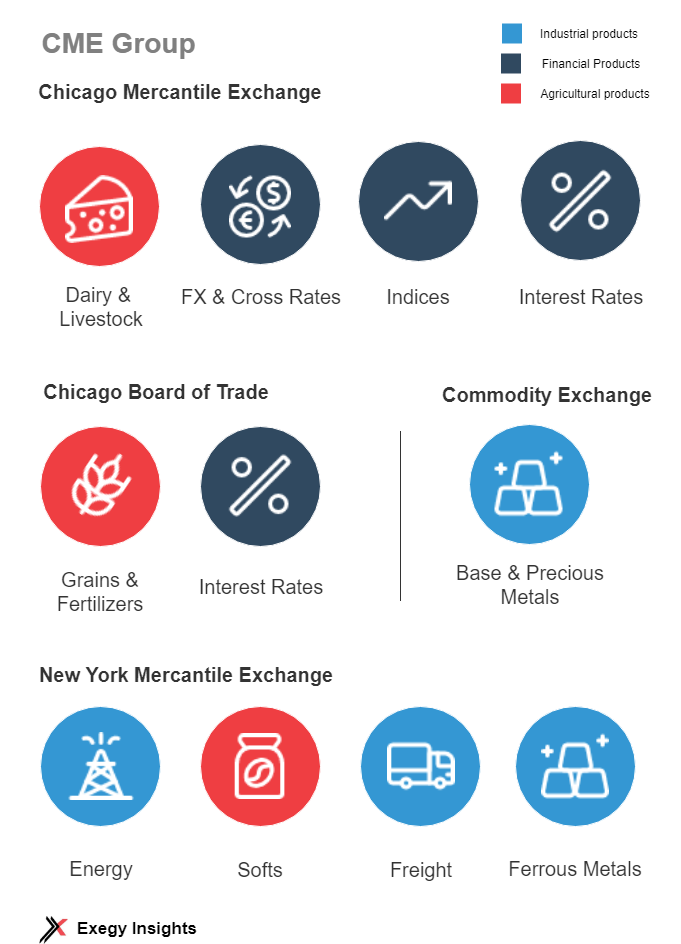

The four exchanges under CME Group’s management are the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the Commodity Exchange (COMEX). Collectively, these 4 exchanges handled nearly 2.5 billion contracts in the first half of 2019. Even as market leaders, their volume represents less than half a trading day on the US equities markets. Yet, the liquidity of the CME should not overshadow the notional value of their contracts, estimated to leverage 8-33 times margin.

Since each exchange designates the contract specifications for a given financial or commodity future, the CME Group tends to organize their exchanges’ products by six categories of futures: Agriculture, Energy, Metals, Equities, Forex, and Interest Rates. CME handles most of the financials products, listing equities indices, foreign exchange futures and cross rates, and short-term interest rates (STIRs). Similarly, CBOT lists swap and US treasury interest rates. Together, the two exchanges manage the agriculture futures from livestock and dairy to grains and fertilizer.

COMEX’s product focus is metals, managing all base and precious metals contracts within the CME Group. Likewise, NYMEX is the focal point for energy futures covering products from biofuels and crude oil to emissions and electricity. In addition, NYMEX handles freight, softs, and ferrous metals products.

As with other financial markets, there are more intricacies to CME Group’s product lines. Despite the focus of financial products on CME and nearly all indices futures listed there, any Dow Jones-derived futures are traded on CBOT instead. Further, the centralization of precious metals on COMEX leaves out Palladium, which is traded on NYMEX. Reviewing the CME Group’s product list is essential to confirming market data needs.

ICE’s Futures Data

The Intercontinental Exchange (ICE)—the parent company of NYSE—manages the fourth largest US futures exchange, ICE Futures US (IFUS), responsible for 6% of the market’s traded contract volume. IFUS is a hub for softs like sugar and coffee; however, much of ICE’s futures contracts are listed on their EU exchange (IFEU). IFEU offers ICE’s energy and interest rates products, serving as the European counterpart to CBOT and NYMEX. In addition to softs, IFUS lists the futures for many MSCI and specialty FANG indices.

Recently, ICE has led the expansion of futures for cryptocurrency by introducing their exchange-traded derivative for Bitcoin. As the first Bitcoin-settled contracts, the Bakkt bitcoin futures are expected to stimulate institutional participation in crypto and take crypto mainstream.

Alternative Exchange Providers

The remaining 1% of market volume is divided across niche exchanges. Of them, the equity leaders—Nasdaq and Cboe—and regionalized agricultural exchanges proliferate on specific products. The Nasdaq Futures Exchange’s (NFX) contracts align most closely with NYMEX’s, as they focus on energy, freight and ferrous metal categories. With fewer product offerings and lower liquidity, NFX focuses on enabling traders to “further diversify their portfolios,” suggesting a complementary strategy.

The Cboe Futures Exchange (CFE) carries 5 financial products; however, nearly 100% of CBOE’s futures market volume is centralized on the VIX volatility index. As one of the most popular global solutions for trading index options, it seems appropriate to see that popularity represented in the futures market.

The two largest regional exchanges, Minneapolis Grain Exchange (MGEX) and Kansas City Board of Trade (KCBT), have a strategic partnership with CME Group. All trading activity for their hard red spring and winter wheat products is conducted through CME’s Globex trading platform. Despite the low relative trading volume, these exchanges offer differentiated value for their particular trading customers. With a pared product offering, the liquidity remains accessible for hedgers and speculators alike.

When Futures Contracts Overlap Across Exchanges

As alluded to, certain contracts overlap among the exchanges. High-volume products like WTI crude futures or forex cross-rate futures are listed with varying contract specifications on CME Group, ICE, and niche exchanges. The contract unit and minimum price fluctuation—e.g. 1,000 barrels and $0.01/barrel for WTI—remain consistent across products. However, factors like trading volume, trading hours, listed contracts, and settlement methods will vary. Selecting the best product for your trade strategy requires understanding these differences and your own expectations for trading.

Table 1. WTI Contract Specifications

| Exchange: Feed | CME Group: NYMEX | ICE: IFEU | Nasdaq: NFX |

| Commodity Code | CL | T | TQ |

| Contract volume,Jan-Jun ‘19 | 152,076,255 | 27,097,168 | 255,868 |

| Contract unit | 1,000 barrels | ||

| Min. price fluctuation | $0.01/barrel or $10/contract | ||

| Settlement | Deliverable | Cash-settled | Cash-settled |

| Trading hours | 6 PM – 5 PM (GMT-5)Sunday – Friday | 1 AM – 11 PM (GMT+1)Sunday – Friday | 7 PM – 6 PM (GMT-4)Sunday – Friday |

| Contract months listed | 122-134 | 108 | 48-60 |

Future Market Data Feeds

Unlike markets for other asset classes, accessing futures liquidity is greatly simplified. In lieu of distinguishing Level 1 and Level 2 feeds, many exchanges offer one, comprehensive feed. For CME Group, the single feed for each exchange distributes both a price and order book quote stream. In contrast, IFUS separates data based on product categories. Their agriculture and financial products separate into two feeds, with the options on those futures also on separate feeds.

Despite the overall simplicity, the instruments in the asset class are more complex than in equities. There is no consolidated system for transmission of quotes and trades, and feeds are disseminated solely from the exchanges. Managing the protocols of each exchange and coordinating them with the feeds of other asset classes makes the value of normalized market data just as prevalent.

Normalized Market Data with Exegy

Normalization of market data standardizes all exchanges’ protocols as a single, consistent format. The Exegy feed handlers ingest a global list of exchange feeds and supply access through one API. This can make a customer’s expansion into new feeds or asset classes seem as simple as flipping a switch.

Leadership in market data normalization has enabled Exegy to develop multiple platforms for accessing our normalized API. To learn more about these solutions, request a consultation with an Exegy market data specialist.

Learn more about the Axiom consolidated market data feed.